So, you’ve decided you need some financial muscle on your team. Smart move. But hiring a CPA isn’t just about finding someone to do your taxes—it’s about bringing on a strategic partner who can actually help you build your business. The first step? Figuring out what kind of help you actually need before you start throwing money at the problem.

Let’s be honest. Every founder eventually hits "the wall." It’s that moment you realize your DIY bookkeeping is less "scrappy startup" and more "five-alarm fire waiting to happen."

You're spending weekends wrestling with payroll, you have zero clue what your actual cash flow looks like, and you’re staring at a tax form like it’s written in a dead language. Forget the generic advice about hitting a certain revenue milestone. The real signs you need a CPA are visceral. They're the gut feelings that tell you you're flying blind.

If any of this sounds familiar, you're in the right place. But before you start drafting a job description, let's pump the brakes. The single biggest mistake I see founders make is hiring a cannon to shoot a fly—or worse, bringing a knife to a gunfight. You need to know exactly what kind of financial help you’re looking for.

Hiring the wrong type of financial pro is like calling a plumber to fix your WiFi. Both are experts, but one is spectacularly useless for your current problem. Let’s cut through the jargon and get straight to who does what.

I've seen too many startups overpay for services they don't need or under-hire and create a massive compliance headache down the road. This table should clear things up.

| Role | What They Actually Do | When to Hire Them | Typical Cost |

|---|---|---|---|

| Bookkeeper | Records daily transactions, manages accounts payable/receivable, reconciles bank statements. They keep your financial records clean. | When you're drowning in receipts and can't keep track of who owes you what. | $25-$75/hour (Contract) |

| Tax Preparer | Swoops in during tax season, takes your (hopefully) clean books, and files your state and federal tax returns. Purely compliance-focused. | When tax season is approaching and you just need someone to file the paperwork correctly. | $300-$1,000+ per return (Flat Fee) |

| CPA | Does everything a bookkeeper and tax preparer can, but adds a strategic layer: tax planning, business structure advice, financial forecasting, and IRS representation. | When you need more than just historical records. You need a partner to help you plan for growth, minimize tax liability, and make smart financial decisions. | $150-$500+/hour or monthly retainers |

Essentially, you hire a bookkeeper to manage the day-to-day, a tax preparer for a specific season, and a CPA to be a year-round strategic advisor.

The Bottom Line: A bookkeeper records the past. A tax preparer reports the past. A CPA helps you shape the future. If you just need your transactions logged, a bookkeeper is your answer. If you need a strategic partner to help you grow, that’s when you hire a CPA.

Now for the fun part. Deciding you need a CPA is one thing; actually finding a good one is a whole other challenge. You aren’t just competing with other startups; you're diving into a market with a serious talent shortage.

Hiring a CPA today is tougher than ever, with unemployment for accounting pros hovering at historic lows of 1-2%. This means nearly every skilled CPA is already employed, forcing companies to poach talent.

To make matters worse, there's been a shocking 33% drop in new people entering the field, while 75% of current accountants are nearing retirement. It's a perfect storm. You can get more details on the accountant talent crisis from CPA Trendlines.

So, what does this mean for you? It means the old ways of hiring—just posting on a job board and waiting for the perfect candidate to appear—are slow, painful, and often ineffective. You need a better strategy, which we’ll get into next.

Alright, so you’ve decided it’s time to hire a CPA. Now what? Hope you enjoy spending your afternoons fact-checking résumés and running technical interviews—because that’s now your full-time job. Or is it?

Let’s be real. When you’re looking to hire a CPA, everyone gives you the same tired advice: ask for referrals, post on job boards, or hire a recruiter. I’ve been down all those roads, and frankly, for a fast-moving business, they're mostly broken.

The traditional playbook for hiring is slow, expensive, and a massive time suck. It was built for a different era, and it really shows.

The root of the problem is that you’re fishing in a tiny, over-fished pond. As we've covered, the US is staring down a massive accountant shortage. Relying on these old channels is like trying to find a parking spot at the mall on Christmas Eve. Good luck.

You don't have a hiring problem; you have a sourcing problem. The best candidates aren't waiting around on local job boards. They're part of a global talent pool you're probably ignoring.

Turns out there’s more than one way to hire an elite CPA without mortgaging your office ping-pong table. The solution is to stop thinking locally and start thinking globally—specifically, Latin America.

Hiring a remote CPA from Latin America isn't just a cost-saving hack; it's a strategic move for quality and efficiency. You gain access to a massive pool of highly skilled, English-fluent professionals who already work in US time zones.

This isn’t about old-school outsourcing. It’s about insourcing top-tier talent. You’re finding a dedicated team member who integrates seamlessly with your operations, understands the urgency of a startup, and brings incredible skills to the table for a fraction of the cost.

This is where specialized talent platforms completely change the game. You need a system that does the heavy lifting for you—the vetting, the technical screening, and the matching. This is the new way to hire.

Speed is everything, especially when US firms are grappling with a shrinking talent pipeline. A recent report from Addison Group found that finance and accounting job openings surged by a staggering 150% in just one year, with 87% of leaders flagging talent shortages as a major hurdle. You can read more about these finance and accounting hiring trends. Traditional hiring methods just can't keep up.

This is exactly why we built HireAccountants. We use AI to instantly match you with pre-vetted candidates from Latin America who are ready to hit the ground running. (Toot, toot!)

Here’s what makes the difference:

Instead of wasting weeks on a painful hiring process, you can find a true strategic partner for your business by tomorrow. You can get a feel for the talent available by browsing some of the top-tier CPAs on our platform. This approach frees you up to get back to what you’re actually good at: running your company.

Let's be honest, the standard interview playbook is broken. If your go-to question is, “So, what’s your greatest weakness?” you're setting yourself up for a perfectly polished, completely useless answer like, “I’m a perfectionist.” Groundbreaking.

Hiring a great CPA isn’t about checking boxes; it's about finding a strategic partner. You're not trying to stump them with arcane tax trivia. The goal is to see how they think, problem-solve, and communicate when the pressure is on. You need to know if this is the person you can trust when things inevitably get messy—and in a growing business, they always do.

So, let's ditch the fluff and ask questions that actually separate the real pros from the résumé padders.

First things first, you have to verify their technical chops. A good CPA should be able to navigate complex accounting concepts without breaking a sweat. It's not just about getting the answer right; it's about explaining it with clarity and confidence.

The best way to do this is to give them a real-world scenario specific to your business. You’re not looking for a textbook definition—you want to see how they apply their knowledge in practice.

Here are a few examples to get you started:

Their response here is incredibly telling. Do they ask smart, clarifying questions? Do they break down the problem into logical steps? Or do they just give you a vague, high-level summary? A great CPA lives in the details.

Technical skills are just the price of admission. The real value—the thing that separates a good CPA from a great one—is their strategic thinking and communication. This is the person who might have to explain why your brilliant new product idea is a financial train wreck waiting to happen. You need someone with both backbone and tact.

These questions are designed to get past the canned responses and see how they really operate.

A quick pro tip: The best interviews are a two-way street. Pay close attention to the questions they ask you. A top-tier candidate will be genuinely curious about your business model, your biggest challenges, and your goals. If they aren’t asking smart questions, they’re probably not thinking strategically.

Finally, you have to see how they communicate. A brilliant CPA who can't explain a balance sheet in plain English is more of a liability than an asset. You don’t have time to be a translator for your own finance expert.

My favorite way to test this is to ask them to simplify a complex topic. It’s a fantastic way to see if they can be a true partner to the whole business, not just a back-office number cruncher.

Try this killer question: "Explain the difference between cash flow and profit as if you were talking to a new marketing intern with zero financial background."

How they handle this reveals everything. Can they connect with the entire team, not just the C-suite? If you’re trying to build a financially literate culture, this skill is absolutely non-negotiable.

At the end of the day, you're not just hiring someone to keep the books clean. You're looking for a partner who can help you read the story the numbers are telling—and then help you write the next chapter. These questions will help you find that person.

Let's talk money. Hiring a CPA can feel like walking into a luxury car dealership blindfolded. Everyone’s friendly, the numbers sound big, and you’re pretty sure you’re about to get taken for a ride.

It doesn’t have to be that way. The key is understanding the game before you play it. You need to know the common engagement models, the hidden costs, and how to structure a deal that doesn’t require you to mortgage the office ping-pong table.

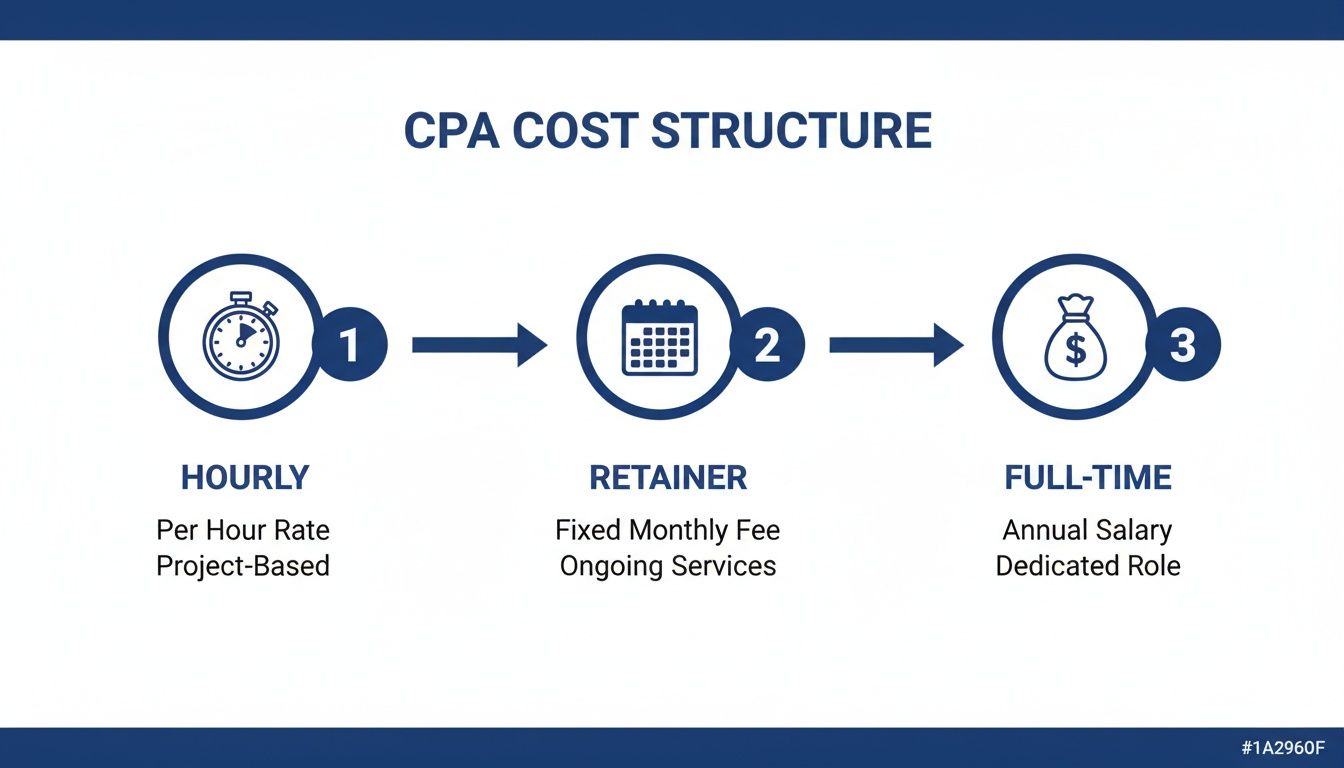

Most CPAs operate on one of three models. None are inherently good or bad, but one is probably a better fit for your business stage than the others. Knowing the difference is your first line of defense against overpaying.

Hourly Rates: The classic "pay-as-you-go" model. It’s great for one-off projects or if you just need a few hours of strategic advice a month. The downside? It can get expensive fast. That "quick question" you had could easily turn into a surprise $500 invoice. This model incentivizes time, not efficiency.

Monthly Retainers: My preferred model for ongoing work. You pay a flat fee each month for a clearly defined set of services—like bookkeeping, monthly financial statements, and tax planning. It makes budgeting predictable and encourages a true partnership. Just make sure the scope of work is crystal clear so you don't get hit with "out-of-scope" charges.

Project-Based Fees: Need to clean up a year's worth of messy books or get an audit done? A fixed project fee is perfect. You agree on a price for a specific outcome. It’s clean, simple, and you know exactly what you’re paying upfront.

The real danger isn't the model itself, but the hidden costs. Watch out for the $500 Hello—that infuriating bill you get just for asking a simple question. A good CPA relationship should include reasonable communication, not a running meter every time you pick up the phone.

My Two Cents: For a growing business, a monthly retainer is almost always the way to go. It aligns your CPA with your success, encourages proactive advice, and eliminates the fear of calling with a question. Just get the scope in writing.

Now for the elephant in the room. What should this all actually cost?

A full-time, experienced CPA in a major US city can easily demand a six-figure salary plus benefits. We’re talking $100,000+ before you even factor in payroll taxes, insurance, and overhead. For most startups and SMBs, that’s just not realistic.

This is where the math gets really interesting. The talent shortage in the US is driving costs skyward. According to Robert Half's Salary Guide, starting salaries for public accounting roles are projected to climb 3.7% year-over-year. It’s a seller’s market, and you’re the buyer.

But what if you could get the same level of expertise—or better—for a fraction of that cost?

That's the insane value proposition of tapping into the global talent pool. Platforms like HireAccountants connect you with pre-screened, English-fluent CPAs in Latin America. You get top-tier talent working in your time zone, but with cost savings of up to 80-90%. We’re talking about landing a full-time, dedicated professional for under $3,000 a month.

Let’s put that in perspective with a quick breakdown.

This isn't just a small optimization; it's a fundamental shift in how you can build a world-class finance team without breaking the bank.

| Cost Factor | Typical US-Based CPA (Full-Time) | Remote CPA via HireAccountants |

|---|---|---|

| Annual Salary | $85,000 – $120,000+ | $24,000 – $40,000 |

| Benefits & Payroll Taxes | ~$20,000 – $30,000 (approx. 25%) | $0 (Included in platform fee) |

| Recruiting Fees | $17,000 – $36,000 (20-30% of salary) | $0 |

| Total First-Year Cost | $122,000 – $186,000+ | $24,000 – $40,000 |

The numbers don't lie. By going remote, you're not sacrificing quality—you're just paying for the talent, not the zip code.

You can see how our straightforward pricing models work and find a plan that fits your budget.

So you did it. You survived the interviews, navigated the pricing talks, and finally hired a CPA. Pop the champagne, right? Not so fast. The hiring part is just the opening act. The real work—and the part where most founders drop the ball—is onboarding.

A bad onboarding process is the fastest way to turn a fantastic hire into a costly, frustrating mistake. You hired them for their brain, not to spend their first three weeks playing detective just to find your chart of accounts. This isn't just about handing over a password; it's about setting them up to deliver value from day one.

Think of it this way: you just bought a high-performance race car. Onboarding is you handing over the keys, showing them where the gas pedal is, and giving them a map of the track. Skipping this step is like leaving them in the garage with no keys and expecting them to win the race.

Forget a week-long orientation. In a remote world, the first two days are critical for setting the tone and giving your new CPA the tools they need to succeed. Your goal is simple: eliminate friction so they can start digging in immediately.

Before they even log on for day one, they should have a clear checklist of what to expect and what they'll get. This isn't the time for ambiguity.

Here’s your non-negotiable tech and info dump:

Don't mistake a flurry of activity for progress. A great CPA's first week should be about deep listening and analysis, not just processing transactions. If they aren't asking a ton of smart, probing questions, that's your first red flag.

Now, let's talk about how you measure success. If you're just tracking hours logged, you're doing it wrong. You hired a strategic partner, not an assembly line worker. You need to define the Key Performance Indicators (KPIs) that actually move the needle.

Forget vanity metrics. We’re talking about tangible outcomes that impact the health of your business.

This infographic breaks down the most common cost structures to consider when hiring a CPA.

The visualization shows that while hourly offers flexibility and full-time provides dedication, a retainer often strikes the right balance for ongoing strategic partnership.

Here are the KPIs I live by for my finance team:

By establishing this framework from the start, you're not just managing a contractor; you're building a relationship with a financial co-pilot. You're giving them the tools, the map, and a clear destination. Now, let them drive.

Okay, we’ve covered a lot of ground. You know when it's time to hire, where to find good candidates, and what to ask. But if you’re like most founders, a few key questions are probably still nagging at you.

That’s completely normal. This is a huge step for your business. To help clear things up, I’ve put together straight answers to the most common questions I hear from entrepreneurs in your shoes. No fluff, just the facts.

Think of it this way: every CPA is an accountant, but not every accountant is a CPA. A Certified Public Accountant (CPA) is someone who has gone through the wringer—passing a notoriously difficult exam, meeting strict educational criteria, and logging thousands of hours of experience to earn those three letters after their name.

This isn't just about a fancy title. That certification means they're held to a higher ethical and professional standard by a state board. Even more crucial, CPAs can legally represent you before the IRS and conduct official financial audits, which a regular accountant simply can't do. An accountant is perfect for managing daily bookkeeping, but a CPA is the strategic partner you need for complex tax planning and high-stakes financial decisions.

This is the classic "how long is a piece of string?" question, but I can give you some real-world numbers. The cost varies wildly depending on how you hire.

Bringing on a full-time, US-based CPA is a serious investment, often costing over $100,000 per year once you add up salary, benefits, and payroll taxes.

For fractional or part-time help, you’re typically looking at hourly rates from $150 to over $500. This can be a great option for one-off projects, but the costs can quickly balloon if you need ongoing support.

The third option is tapping into remote talent, which has been a complete game-changer. By looking at global talent pools, you can hire a full-time, dedicated CPA for a fraction of the cost—often for under $3,000 per month. You get the same level of expertise, just without the eye-watering price tag.

Over the years, I've learned to trust my gut, and you should too. But there are a few specific red flags that should make you hit the brakes immediately.

The biggest red flag of all? Poor communication during the hiring process. If they're slow to respond or unclear now, imagine what it will be like when you have an urgent tax question. How someone acts when they're trying to win your business is the absolute best they're ever going to be.

Hiring the right CPA is a critical step, but it doesn’t have to be a painful one. For more insights, you can find a wealth of information in our complete guide to common accounting questions.

Ready to stop wrestling with spreadsheets and find a world-class CPA who won't break the bank? At HireAccountants, we connect you with pre-vetted, English-fluent finance professionals from Latin America in as little as 24 hours. Get the strategic partner you need at a price you can actually afford. Find your perfect CPA today.

Let's simplify your finances today!