Let’s get one thing straight: hiring a bookkeeper isn’t just about ticking a box. It's a strategic move to stop the financial chaos that’s secretly killing your business. The goal isn't just to have someone log receipts; it’s to bring in a pro who can give you the financial clarity you need to actually lead. This is about defining what you really need, picking the right hiring model (because they are not all created equal), and finding someone who can do the work without you looking over their shoulder.

You didn’t start a business to become a part-time data entry clerk, but here we are. You’re drowning in a sea of uncategorized expenses, and your P&L statement looks more like a Jackson Pollock painting than a useful report. This isn’t just a minor headache—it's a boat anchor tied to your company's growth.

That “I’ll get to it later” mentality is a killer. Every month you procrastinate, the mess gets bigger. Before you know it, tax season is a five-alarm fire, and that big investor meeting you were amped about becomes a source of pure dread. Nothing makes you sweat like an investor asking for clean, up-to-date financials you just don't have.

Ignoring your books isn't saving you money. It's costing you a fortune in ways you haven't even considered. Bad bookkeeping leads directly to:

This pain is universal, but the old-school solution—just hiring someone down the street—is getting tougher. The US accounting workforce has shrunk, with over 300,000 roles either vacated or outsourced. This talent crunch means that for many growing companies, simply hiring locally is no longer a viable option. You can read more about the future of accounting outsourcing and why this is happening.

The decision to hire a bookkeeper isn’t an expense. It's one of the highest-ROI investments you can make. It’s the difference between guessing and knowing, between just surviving and actually scaling.

If you’re spending more than a few hours a month wrestling with spreadsheets or you can’t confidently explain your cash flow in 30 seconds, you needed a bookkeeper yesterday. It’s time to stop being your company's overpaid data entry clerk and get back to being its CEO.

So, you’ve decided you need help with your books. Smart move. But not all bookkeepers are created equal, and choosing the wrong hiring model is like bringing a sledgehammer to fix a Swiss watch—a costly, messy mistake.

Forget the sanitized, neutral comparisons you see everywhere else. I’ve tried just about every option out there, collected the receipts (pun intended), and can tell you what actually works in the real world. This is the breakdown of the four main ways you can hire a bookkeeper, complete with the pros, cons, and the hidden costs they conveniently leave out of the brochure.

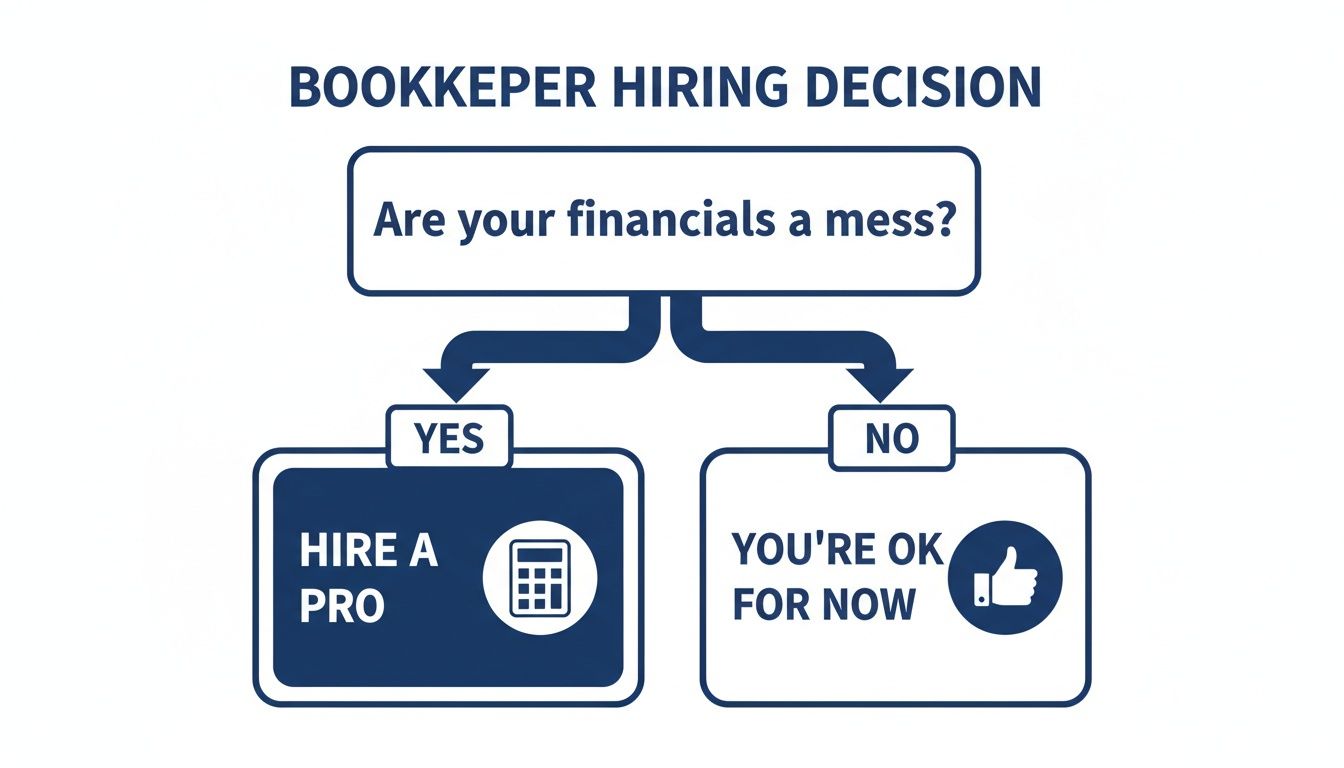

First things first, let's settle the most important question with this simple decision tree.

If you found yourself nodding along and landing on "yes," then it's time to pick the right kind of help for your business.

This is the old-school approach: a W-2 employee sitting in your office, fully dedicated to your company's financials. On paper, it sounds fantastic. Total control, immediate access, and someone who’s (in theory) plugged into your company culture.

But here’s the reality check: it’s an incredibly expensive way to solve the problem, especially for a startup or small business. You’re not just paying a salary, which for a decent US-based bookkeeper starts around $50,000 and climbs quickly. You're also on the hook for payroll taxes, health insurance, retirement contributions, and PTO.

Suddenly, that one hire is costing you north of $65,000 a year. And for what? For someone who might only have 15-20 hours of actual bookkeeping work a week and spends the rest of their time perfecting their fantasy football lineup. It’s a luxury most of us simply can’t afford.

Okay, so a full-timer is out. What about a local freelancer? This option gives you flexibility without the W-2 overhead, and it can work for very early-stage companies with dead-simple books. You might find someone on a local job board who charges anywhere from $30-$75 per hour.

But this model is riddled with trapdoors.

It’s a decent stopgap, but it’s rarely a long-term fix.

Next up: the faceless online bookkeeping services. You’ve seen their ads—cheap, automated bookkeeping for a temptingly low monthly fee. You sign up, connect your bank accounts, and get assigned to a “dedicated” team.

Here’s the dirty little secret: your “dedicated team” is a revolving door of junior bookkeepers in a call center, handling hundreds of other clients just like you. Communication is glacial, responses are canned, and you’ll spend more time correcting their mistakes than you would have spent doing the books yourself.

These services sell the dream of a hands-off solution, but in practice, they often create more work. You get what you pay for, and when you pay rock-bottom prices, you get rock-bottom engagement.

They're great at processing a high volume of simple transactions. But if you need someone to understand the nuances of your business, offer proactive advice, or fix a complex issue? Good luck getting a human on the phone who even knows your company's name.

This is where the game completely changes. Instead of choosing between an expensive employee and an unreliable freelancer, you can hire a dedicated, pre-vetted remote professional. This model combines the best of all worlds: the focus of an in-house hire with the cost-effectiveness and flexibility of outsourcing.

Platforms that specialize in connecting US companies with top-tier talent in Latin America have cracked this code. You get access to English-fluent, highly skilled professionals who work in your time zone but at a fraction of the cost. Think of it as finding an A-player for your team without having to mortgage the office ping-pong table.

This isn’t just about saving money. It’s about getting a true partner for your business—someone who is dedicated to your success and has the skills to back it up. You get the quality and control of an in-house employee without the crippling overhead. For us, and for countless other growing businesses, this was the clear winner. If you're ready to see what this looks like, you can find pre-vetted bookkeepers ready to integrate with your team.

The $500 Hello vs. The $5,000 Mistake. To make the decision even clearer, I've broken down how these four models stack up against each other on the factors that actually matter: cost, control, and scalability.

| Hiring Model | Typical Monthly Cost (USD) | Level of Control | Best For | Biggest Red Flag |

|---|---|---|---|---|

| Full-Time In-House | $5,500+ (fully loaded) | Total | Large companies with complex, high-volume financials. | Extremely high cost and low utilization for most SMEs. |

| Local Part-Time Freelancer | $500 – $1,500 | Moderate | Very early-stage startups with simple, infrequent needs. | Inconsistent availability and a huge variance in skill level. |

| Big-Box Bookkeeping Service | $300 – $900 | Low | Businesses with very basic, high-volume transactional needs. | Impersonal service; you're just another account number. |

| Integrated Remote Professional | $1,800 – $3,500 | High | Growth-stage businesses needing quality and cost-efficiency. | Requires a company culture that embraces remote team members. |

As you can see, the "right" choice depends on your budget and how much control you crave. For most growing businesses, the value, skill, and dedication of an integrated remote professional are almost impossible to beat.

Let's get one thing straight: a generic job description attracts generic candidates. It’s a magnet for people who just want a job, not your job. If your job description reads like a copy-paste from a textbook—"reconcile accounts," "manage payables"—prepare to spend weeks sifting through resumes from people who will do the bare minimum.

Your job description isn’t just a list of tasks; it’s a filter. It’s your first and best tool for weeding out the uninspired and attracting the professionals who actually care about making an impact. This is your chance to sell the role, the company, and the mission. Don't blow it.

Nobody gets excited about a bulleted list of chores. Instead of listing what the person will do, describe what success will look like. Shift the focus from mindless tasks to meaningful outcomes. This single change will dramatically improve the quality of your applicants.

Instead of: "Process accounts payable and receivable."

Try: "Own our cash flow cycle by ensuring vendors are paid on time and invoices are collected within 30 days, keeping our business healthy and predictable."

Instead of: "Prepare monthly financial reports."

Try: "Deliver crystal-clear financial reports by the fifth of each month that give the leadership team the insights to make smart, fast decisions."

See the difference? One is a chore list; the other is a mission. A-players are drawn to missions, not chores.

A great job description makes a candidate feel like a key player before they’ve even applied. It frames the role as an opportunity to solve important problems, not just to check boxes.

This approach immediately filters for people who think strategically. You’re not just looking for a human calculator; you're looking for a financial partner who understands why the numbers matter.

Ambiguity is your enemy. Be brutally honest about your expectations and the tools you use. This saves everyone time and ensures you’re talking to people who can hit the ground running.

Your Tech Stack:

Don't just say "experience with accounting software." Name names. Are you a die-hard QuickBooks Online shop? A Xero fanatic? Mentioning the specific software is a non-negotiable. Also, list any adjacent tools they’ll use, like your payroll provider (Gusto, Rippling) or expense management software (Ramp, Expensify).

Your Communication Cadence:

How do you operate? Set the expectation now, not after they're hired. Be direct.

This clarity repels candidates who prefer to work in a black box and attracts those who value proactive communication.

Finally, inject a bit of your company's personality. Are you a heads-down, no-nonsense team or a sarcastic crew that celebrates wins with terrible puns? A sentence or two about your culture can be the tiebreaker. You're not just hiring a skill set; you're hiring a person. Make sure they know what they’re signing up for.

Alright, you’ve got a killer job description. Now what? Post it on a job board and pray? That’s not a strategy. It’s a recipe for spending the next three weeks sifting through a mountain of wildly unqualified resumes.

Hope you enjoy spending your afternoons fact-checking resumes and running interviews—because that’s now your full-time job. The old way of hiring is broken, especially for specialized talent. You need a tactical map, not a lottery ticket.

Let's quickly roast the usual haunts where founders go to find talent. I've wasted more time and money on these platforms than I care to admit, so allow me to save you the trouble.

LinkedIn: It's the world’s biggest professional network, which is also its biggest problem. Posting a job here is like shouting into a hurricane. You’ll get hundreds of applicants, and 95% of them won’t have read past the job title. It's a volume game, not a quality game.

Upwork/Fiverr: These marketplaces can be fine for a one-off project, but hiring a dedicated bookkeeper is different. You're swimming in a sea of freelancers with wildly varying skill levels, and the platform’s incentive is transactions, not quality relationships. It’s a race to the bottom on price—which is exactly where you don’t want to be with your financials.

Local Job Boards: In theory, this sounds great. In practice, you're fishing in a tiny pond. The local talent pool for specialized roles is often shallow and overpriced.

The fundamental problem with these channels is they put all the work—the sourcing, the filtering, the vetting—squarely on your shoulders. You’re already running a business; you don’t have time to become a full-time recruiter.

There’s a much smarter, faster way to do this. Instead of casting a wide net and hoping for the best, you go where the best candidates have already been gathered, vetted, and organized for you. This is the magic of curated talent platforms.

This is where a service like HireAccountants completely flips the model on its head. We’re not a job board; we’re a pre-vetted talent pool. (Yes, that’s a shameless plug, but stick with me—it’s relevant. Toot, toot!)

Instead of you hunting for candidates, we bring the candidates to you. Every single professional on our platform has already been through a rigorous screening process.

Think of it this way: the old model forces you to be a detective, piecing together clues from resumes and interviews. The new model lets you be a director, choosing from a cast of pre-screened, proven actors.

This approach is especially powerful when you look beyond your zip code. The talent shortage is real and getting worse. Recent reports show that a staggering 87% of finance leaders are struggling with a critical talent shortage, with open accounting roles jumping 150% year-over-year. You can read the full breakdown of this hiring crunch to see why speed is now a competitive advantage. You can’t afford to wait.

This is where things get really interesting. One of the biggest unlocks for our business—and for countless other startups—has been tapping into the incredible pool of talent in Latin America. We’re talking about highly educated, English-fluent, and ambitious professionals who are ready to work in your time zone.

Why is this such a game-changer?

Hiring a bookkeeper doesn’t have to be a months-long, soul-crushing saga. By ditching the traditional job boards and using a curated platform focused on a specific talent hub, you can transform a major business headache into a quick, strategic win. It’s the ultimate shortcut for founders who value their time—and their sanity.

This approach isn't just for bookkeepers; you can check out our guide on finding a great accountant using the same principles.

Anyone can look good on a Zoom call for 30 minutes. They’ll smile, nod, use all the right buzzwords, and talk a big game about their “attention to detail.” Your job is to look past the performance. The interview isn’t about finding someone you like; it’s about finding someone who can actually do the job without creating an even bigger mess.

This is where you separate the talkers from the doers. Forget the tired, generic interview questions that only get you rehearsed, useless answers. You need a playbook that stress-tests their actual, practical skills.

This image nails it. The interview is about connection, but the skills test is about proof. The real truth comes from seeing how a candidate works, not just how they present themselves on camera.

Ditch "What's your greatest weakness?" unless you really want to hear a made-up story about being "too detail-oriented." Instead, ask questions that force candidates to think on their feet and reveal their problem-solving process.

Here are a few of my go-to's that reveal more than any résumé ever could:

These aren't trick questions. They’re grounded in real-world scenarios designed to see how a candidate thinks, communicates, and acts under pressure.

An interview tells you if they can talk the talk. A skills test shows you if they can walk the walk. This is, without a doubt, the most critical step in your entire vetting process. It’s where the real contenders shine and the pretenders are quickly exposed.

This doesn't need to be some long, unpaid project—that's just disrespectful. The best approach is a small, paid practical exercise that mirrors the actual work they’ll be doing. Pay them for one or two hours to complete it. This small gesture shows you value their expertise and immediately filters for serious candidates.

The skills test isn't just an evaluation; it's a paid trial. It's the closest you can get to seeing their real work product before you sign a contract. It's the best $50 you'll spend in your entire hiring process.

My go-to test is simple but incredibly revealing. I'll send over a CSV file with about 30 messy bank transactions and ask them to:

This little exercise tests their attention to detail, their software proficiency, and most importantly, their critical thinking. It’s not about getting it 100% right. It's about seeing their process and how they communicate when faced with incomplete information. The candidates who ask smart, clarifying questions are almost always the ones you end up wanting to hire.

You did it. You found your person. After all the job descriptions, interviews, and skills tests, you’re at the one-yard line. Don’t fumble the ball now with a sloppy offer and a chaotic onboarding process. This isn't just boring bureaucracy; it's about making your new hire feel confident and getting an ROI on them as fast as humanly possible.

It all starts with a clear, professional offer. Spell out the compensation, role, responsibilities, and start date. No surprises.

This is also where hiring from global talent hubs pays off big time. Cost savings of 50-70% are what drive so many businesses to hire offshore bookkeepers, transforming the answer to "how to hire a bookkeeper" from a local chore into a global strategy.

While the median US bookkeeper earns over $49,000 yearly, hiring pre-vetted talent in Latin America through a platform like HireAccountants can drop that to under $3,000/month—without lowballing or sacrificing quality. You can explore more details on finance and accounting hiring trends to see how this shift is reshaping the entire industry.

Before Day One, get your house in order. A smooth start shows you’re a pro. It builds immediate trust and lets them hit the ground running instead of chasing you for logins.

Forget some complicated, overwhelming plan. Your goal here is clarity and a few quick wins. Structure their first month around learning, doing, and reporting back.

A great onboarding plan isn't a list of tasks; it's a guided tour of your business's financial engine. Their job is to learn how it runs, find the leaks, and make it more efficient.

Here’s a simple, effective framework:

Week 1: Discovery & Setup

Their main job is to absorb information. Schedule a few short intro calls with key people (your ops lead, co-founder, etc.). Their goal is to understand how money actually flows through the business, review historical books, and flag any immediate questions or red flags.

Weeks 2-3: The Cleanup & Cadence

Now they start doing the real work. The first major task should be reconciling the previous month's accounts. This is their deep dive. They should also establish a weekly reporting rhythm—a simple email with cash balance, A/R aging, and any critical issues is perfect.

Week 4: Ownership & Optimization

By now, they should be operating pretty independently. Their focus shifts from cleanup to ownership. Ask them to present a brief "State of the Books" report, highlighting what's working, what's not, and one or two solid suggestions for process improvements. This is how you turn a bookkeeper into a true financial partner.

You've made it this far, but a few nagging questions are probably still bouncing around in your head. It’s the kind of stuff that keeps founders up at night. Let's tackle them head-on with some straight answers.

Honestly, the costs are all over the map, and it's easy to get it wrong.

A full-time, US-based bookkeeper will run you $50,000+ a year before you even think about benefits. A local freelancer could be anywhere from $30 to $75 per hour, which adds up faster than you'd think.

The real game-changer is tapping into the global talent pool. Hiring pre-vetted, remote professionals from Latin America gives you access to dedicated, full-time experts for under $3,000 a month. You get the quality and focus of an in-house hire without the massive overhead. We're not saying we're perfect, just more accurate more often when it comes to finding value.

Think of it this way: your bookkeeper is in the financial trenches every single day. They’re recording transactions, reconciling accounts, and keeping your data pristine. They handle the daily financial grind.

An accountant or a CPA takes that clean data and uses it for high-level strategy—filing complex tax returns, performing audits, and building financial forecasts. You absolutely need the bookkeeper first to make the accountant's job possible (and a whole lot cheaper).

If you want to dive deeper, you can explore answers to common talent questions to see how different finance roles fit together.

This is a big one, but it's a solved problem.

Trusting a remote professional with your financials feels like a leap of faith, but with the right systems, it's just as secure as having someone down the hall—often more so.

First, always use a platform that thoroughly vets its talent. Don't just pull someone off a random job board.

Second, modern cloud-based software like QuickBooks Online or Xero is your best friend. You can grant specific, limited user permissions so they only see what they need to see.

Finally, enforce strong password policies, use a secure password manager like 1Password, and make sure a crystal-clear contract and a signed NDA are in place. These simple guardrails are non-negotiable and will give you complete peace of mind.

Ready to skip the endless searching and connect with top-tier, pre-vetted bookkeepers? At HireAccountants, we match you with English-fluent finance professionals from Latin America in as little as 24 hours, saving you up to 80% on hiring costs. Find your perfect financial partner today at https://hireaccountants.com.

Let's simplify your finances today!