Let's cut the corporate jargon. The difference between a CFO and a Controller is simple: one looks through the windshield, the other stares into the rearview mirror. A CFO is obsessed with the future, while a Controller masters the past. The CFO asks, “Where are we going and how do we get there without running out of gas?” The Controller asks, “Where have we been, and are these numbers even real?”

You’ve probably hit that stage. That painful moment when you realize your late-night spreadsheet tango isn't just a grind—it's a genuine risk. But hiring your first senior finance pro feels like betting your entire runway on a single hand of poker.

Mess it up, and you’ll either pay a strategist’s salary for glorified bookkeeping or ask a tactical numbers expert to charm a room full of VCs. I’ve seen it a dozen times. It’s a classic—and costly—startup mistake.

So, who do you actually need? Think of it this way: the CFO is your co-pilot, using the dashboard to navigate storms, find shortcuts, and plan the destination. The Controller is your flight engineer, obsessed with making sure every dial, gauge, and sensor on that dashboard is 100% accurate. You need both to fly, but you don't hire them at the same time.

The bottom line: A CFO is a forward-looking strategist, focused on creating future value. A Controller is a backward-looking tactician, focused on preserving and accurately reporting on what’s already happened. Who you hire first is one of the most critical decisions you'll make.

Forget the jargon-filled job descriptions HR loves. Let's break down the CFO vs. Controller debate into what actually matters when you're the one signing the checks. This table cuts through the noise.

| Dimension | The Controller (The Historian) | The CFO (The Strategist) |

|---|---|---|

| Primary Focus | Accuracy, compliance, historical reporting. They make sure the books are squeaky clean. | Growth, strategy, future performance. They use financial data to raise capital and make big bets. |

| Key Question | "How did we do last month?" | "Where will we be in three years?" |

| Core Skillset | Deep accounting (GAAP), internal controls, audit management, process optimization. | Financial modeling, investor relations, capital allocation, risk management, M&A. |

| Main Deliverable | Accurate, timely financial statements (P&L, Balance Sheet, Cash Flow). | Strategic financial plan, fundraising decks, board reports, five-year forecasts. |

| Success Metric | A clean, fast month-end close and a flawless audit. | Securing a funding round, improving your burn multiple, or finding a brilliant acquisition. |

Ultimately, a Controller builds the reliable financial foundation that a CFO uses to construct the company's future. The Controller gives you the "what," and the CFO translates it into the "so what" and "what's next." Figuring out which of those questions is keeping you up at night right now tells you who to hire.

Okay, so one looks back, the other looks forward. But what does that actually mean on a chaotic Tuesday afternoon when everything is on fire? What are these people doing all day?

Because here’s where the real distinction between a CFO and a Controller comes alive. One person is building a rock-solid engine, and the other is charting the map for a cross-country journey. You wouldn’t ask your mechanic to be your navigator.

Imagine your company’s financial operations as a high-end restaurant kitchen. The Controller is the head chef, obsessed with process, precision, and consistency. Their job is to make sure every ingredient is accounted for and every dish that leaves the kitchen is perfect—and exactly the same as the last time.

They live and breathe historical data. Their day is a whirlwind of tactical execution, all centered on making sure your financial foundation is solid, compliant, and, most importantly, accurate. They aren't guessing; they are verifying.

Here’s what their to-do list actually looks like:

A Controller’s job is to eliminate surprises. Their victory is a clean audit and financial statements so reliable you could set your watch to them. If your auditor is questioning your revenue recognition policy, you’re paging the Controller, not the CFO.

If the Controller is the head chef, the CFO is the restaurateur. They aren’t cooking; they’re deciding whether to open a new location, pivot the menu, or raise a round of funding to franchise the whole operation.

The CFO takes the pristine historical data from the Controller and uses it to tell a story about the future. They translate numbers into a narrative that investors, board members, and you can use to make massive, company-altering decisions.

Their day-to-day looks completely different:

The difference is clearest in a crisis. The Controller tells you how much cash you have today. The CFO tells you how to make that cash last six months longer than you thought possible.

Let's talk about the number that really matters: the salary. Hiring your first senior finance role is a terrifying new line item on your P&L. A full-time, US-based CFO can feel like mortgaging your company's future before it even has one.

This is where the CFO vs. Controller debate gets brutally simple. You’re not just hiring for a different skillset; you’re hiring in a completely different financial orbit. One is a major investment. The other is a strategic, C-suite executive hire that can make or break your company.

Let's break down the raw numbers. If you're looking at US-based talent, the sticker shock is real. A seasoned Controller in a major tech hub will likely set you back $150,000 to $200,000 in base salary. It's a serious hire, but manageable for a company that desperately needs its financial house in order.

A CFO is a whole different ballgame. You’re not just paying for accounting chops; you’re paying for a strategic network, fundraising prowess, and battle-tested experience. For that, you can expect a base salary well north of $300,000.

The gap is even bigger than you think. The average US-based CFO pulls in a base salary around $419,000, while Controllers average $239,000. Even for smaller companies, a Controller might cost $200,000 fully burdened, compared to a whopping $300,000-$350,000 for a CFO.

And the base salary is just the opening bid. The total cost is where the real damage is done.

Here’s what you’re really paying for:

It's a painful calculation. You know you need the expertise, but looking at the numbers feels like choosing between financial discipline and having enough cash to survive the next two quarters.

For years, this was the brutal choice. Bite the bullet on an eye-watering hire, or struggle with messy books and a prayer. But that’s not the world we live in anymore.

There’s a much smarter, more capital-efficient way to do this. It’s a playbook we’ve seen work time and again, and it doesn't involve auctioning off your office furniture.

The secret? Stop thinking in terms of traditional, US-based, full-time hires for every role. The game-changer is leveraging pre-vetted, expert global talent to handle your operational backbone.

Instead of paying $200,000 for a Controller in San Francisco, you can hire an equally skilled, pre-vetted professional from a global talent pool for a fraction of that—sometimes slashing your costs by 80-90%. This isn’t about cheap labor; it’s about finding incredible talent in a different market. You get an expert who works in your time zone, is fluent in English, and has the skills to manage your books flawlessly. If you're curious, here are the benefits of outsourcing accounting services.

This approach flips the script. By building a robust and affordable accounting engine with a remote Controller, you free up a ton of capital. Now you can afford to bring in a high-powered fractional CFO for 5-10 hours a week to handle strategy and fundraising.

You get the best of both worlds: a bulletproof accounting foundation and elite strategic advice, all for less than the cost of one full-time, US-based Controller. That’s how modern companies are built.

Hiring the right finance role at the wrong time is a classic, cash-burning startup mistake. A founder celebrates a seed round by hiring a big-shot CFO, only to realize they’re paying a strategist’s salary for glorified bookkeeping.

On the flip side, waiting too long to hire a Controller is just as dangerous. Your financials become a dumpster fire right as VCs start sniffing around, and you’re left scrambling to clean up a year’s worth of sloppy accounting. Neither scenario ends well.

This is about timing your hires to match your company's actual growth. Let’s map it out.

In the early days, you’re in survival mode. Your financial needs are simple: keep the lights on, invoice customers, and don't run out of cash. A full-time Controller, let alone a CFO, is complete overkill.

At this stage, your best friend is a solid bookkeeper or a sharp junior accountant. Their job is to manage the fundamentals—AP, AR, and payroll. You can often find incredible, pre-vetted talent on a part-time or outsourced basis, which is the smart, capital-efficient move.

Your goal is simple: establish clean, basic financial hygiene. Don't overcomplicate it.

This is where things get serious, and it’s where most founders trip up. Once you cross the $5M ARR threshold, your financial complexity explodes. You have more customers, more employees, and a tidal wave of transactions. Spreadsheets won't cut it.

This is the non-negotiable moment to hire your first Controller.

Why a Controller? Because your most urgent problem isn’t grand strategy; it’s operational chaos. You need someone to build the systems and processes that will allow you to scale without imploding. A Controller will:

A Controller brings discipline. They build the reliable foundation you’ll need for the next stage. Industry data confirms this is the sweet spot; Controllers are ideal for growing firms needing accurate reporting and compliance, typically when revenues hit the $5 million to $50 million range. You can see more expert insights on this hiring timeline.

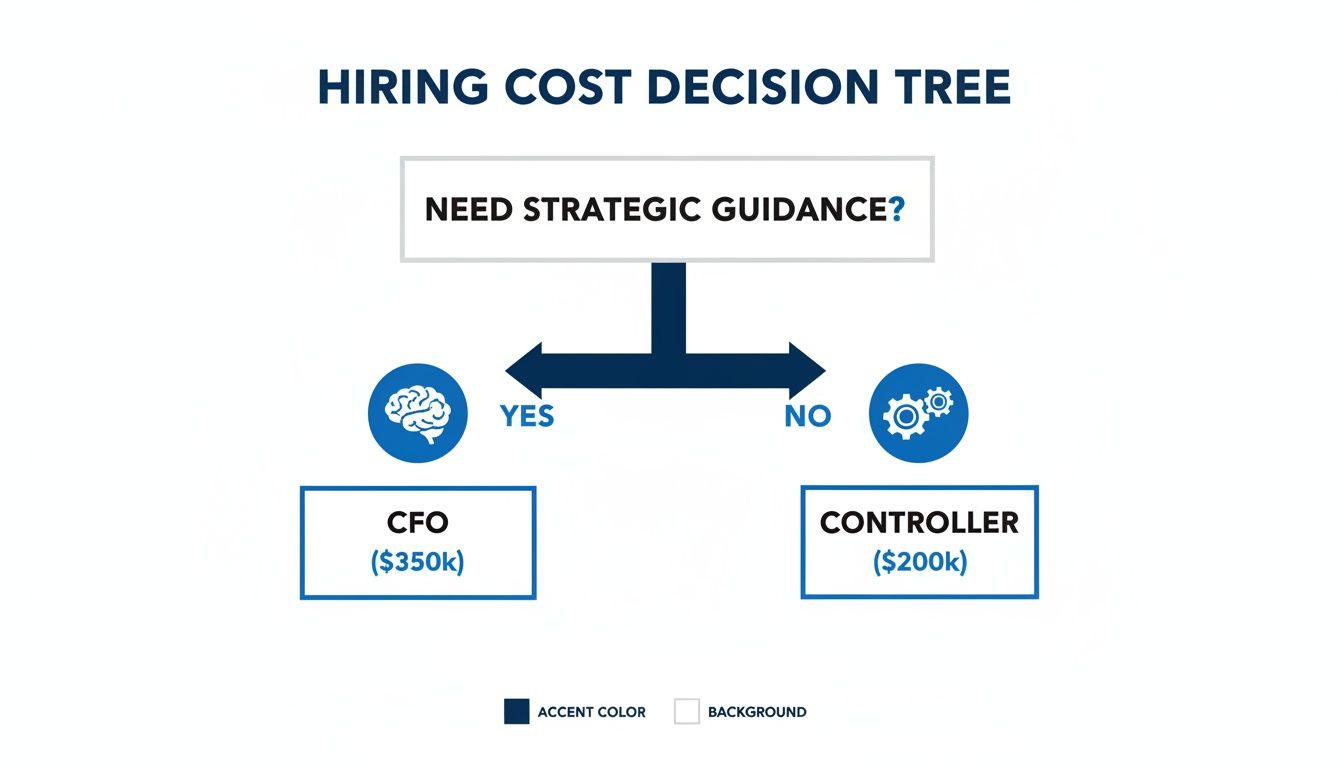

This simple decision tree illustrates the core difference in cost and strategic need at this stage.

The visualization cuts right to the chase: if you need tactical execution, a Controller provides that horsepower at a much more manageable cost.

Once you’re pushing past $50M ARR, the game changes entirely. Your challenges are no longer just operational. You’re facing complex questions about market expansion, M&A, capital allocation, and a potential IPO.

This is when you hire a strategic CFO.

Your Controller has built a pristine financial engine. Now, you need a pilot. The CFO will take the accurate data your Controller produces and use it to:

A quick reality check: Many founders get impatient and hire a full-time CFO when what they really need is a fractional CFO. If your main goal is fundraising, consider bringing on a part-time expert just for that. It gives you the firepower you need without the full-time burn.

At this stage, your finance team structure finally solidifies. The Controller reports to the CFO, creating a powerful partnership. The Controller ensures the "what" is accurate, while the CFO focuses on the "so what?" and "what's next?"

So, you’ve decided a Controller is your next mission-critical hire. Fantastic. Hope you enjoy spending your afternoons fact-checking resumes and running technical interviews—because that’s now your full-time job.

Unless, of course, you do it the smart way.

Hiring your first real finance leader feels like a high-stakes poker game where you’re not entirely sure of the rules. You need someone with the technical chops to handle GAAP but also the grit to build systems from scratch. That’s a rare combination, and finding it is a soul-crushing slog.

The first mistake founders make is getting fixated on credentials. They see "CPA" on a resume and think, "Great, they know accounting." That’s like hiring a chef just because they own a set of knives.

A CPA tells you they can pass an exam. It doesn’t tell you if they can handle the beautiful chaos of a scaling startup.

What you should actually be looking for is a track record of building, not just maintaining. You want to see keywords that signal real, hands-on operational excellence:

The best Controllers aren’t just accountants; they’re systems builders. They see your messy financial processes not as a problem, but as a puzzle they’re dying to solve. That’s the grit you’re looking for.

Standard interview questions are useless. "Tell me about a time you faced a challenge" will get you a perfectly rehearsed, perfectly unhelpful answer. You need to throw them into a real-world fire.

Forget the fluff. Get tactical with situational questions that test their problem-solving skills and their nerve.

| Question Category | Sample Question | What to Look For in the Answer |

|---|---|---|

| Crisis Management | "You've just closed the books and discovered a major revenue recognition error from last quarter. Walk me through your next 48 hours." | A calm, systematic approach. They should talk about quantifying the error, communicating with leadership (that’s you), and drafting a plan to correct the statements. Bonus points for mentioning investor communication. |

| Process Building | "Our current expense reporting is a mess of emails and spreadsheets. Your budget is limited. What’s your 90-day plan to fix it?" | Pragmatism. They shouldn't jump to a $50,000 software solution. A great answer involves creating a simple policy, using affordable tools, and focusing on user adoption. They should solve the problem, not just buy a tool. |

| Technical Acumen | "We are considering expanding our sales into Europe. From an accounting perspective, what are the top three things that keep you up at night?" | Proactive thinking. A sharp candidate will immediately bring up VAT, transfer pricing, and multicurrency accounting. It shows they’re thinking ahead, not just reacting. |

These questions don't just test their knowledge; they test their judgment. In a Controller, judgment is everything. While this process is critical for a Controller, you can adapt a similar mindset if you're looking to learn more about how to hire a bookkeeper for an earlier-stage role.

Let’s be honest. You don’t have time for this. Running a company is hard enough without adding "part-time finance recruiter" to your job description. The endless cycle of sourcing, screening, and interviewing can drag on for months—months you simply don’t have.

This is where you stop playing their game and start playing yours.

Instead of sifting through a mountain of unqualified resumes, you can tap into platforms that offer pre-vetted, expert financial talent. (Toot, toot!) At HireAccountants, we’ve already done the hard part for you. Every candidate has been rigorously screened for technical skills, communication, and real-world experience in high-growth environments. We're not saying we're perfect. Just more accurate more often.

You get to skip the entire top-of-funnel disaster and go straight to interviewing a shortlist of A-players. The result? You can hire a world-class Controller in days, not months, and get back to running your company.

Alright, even after laying it all out, the lines can get fuzzy. Founders are always trying to assemble their financial A-team without mortgaging the office ping-pong table, and the "CFO or Controller?" debate is a big one.

Let's cut through the noise and tackle the questions we hear all the time. No corporate jargon—just straight answers.

Absolutely. It’s a classic career path. A top-notch Controller develops an almost encyclopedic knowledge of how the company's money moves. They know the "what" and the "how" of your financials better than anyone.

But to make that leap, their entire mindset has to shift. They have to move beyond reporting on what has happened and start shaping what will happen. It's about graduating from historical accuracy to forward-looking strategy.

To get there, they need to build muscle in a few key areas:

For a founder, promoting a high-potential Controller from within can be a huge win. You keep all that invaluable institutional knowledge. Just be ready to invest in their development.

Eventually? Yes. In a mature finance department, the Controller always reports to the CFO. It's a perfect yin and yang: one builds the engine, the other pilots the plane.

But for a startup, hiring both full-time is like renting a tuxedo for a backyard barbecue—overkill and a massive waste of cash. The key is a phased approach.

You almost always start with a Controller (or an outsourced accounting firm) to get your house in order. Once the books are clean and your reports are reliable, then you can bring in a fractional CFO to help navigate a specific fundraising round or market expansion.

The Controller’s work is the raw material for the CFO’s strategy. Hiring a CFO without a solid Controller is like asking an architect to design a skyscraper on a foundation of quicksand. It’s not going to end well.

Getting this right is crucial. It’s all about deploying your capital for maximum impact.

A fractional CFO is a part-time strategic advisor. You're renting a high-powered executive brain for a few hours a week. Their job is to guide you through fundraising, prep for board meetings, and help you wrestle with the big, company-defining decisions. They are a strategic weapon you bring in for key missions.

An outsourced Controller, on the other hand, is your operational powerhouse, often sourced from a global talent platform. They are in the engine room every day—managing the accounting close, overseeing compliance, and making sure the entire function just works. They are an affordable, essential utility.

The savviest founders combine these two models. They build a cost-effective, reliable accounting engine with an outsourced Controller, then layer a fractional CFO on top for high-level strategic oversight. It’s the secret to getting a world-class finance function without the eye-watering price tag.

Ready to build your financial engine the smart way? HireAccountants gives you access to pre-vetted, expert accountants and controllers from a global talent pool, letting you hire in days, not months, at a fraction of the cost. Find your perfect finance hire today.

Let's simplify your finances today!