Let's cut the crap. Financial Planning and Analysis (FP&A) is the strategic brain of your business. It tells you where you've been, where you are now, and—most importantly—where you're headed. It’s the difference between flying blind and having a GPS, a co-pilot, and a full weather report.

Ever tried driving to a new city by only looking in your rearview mirror? Ridiculous, right? Yet that’s exactly what you’re doing when you run a business on accounting data alone.

Look, traditional accounting is essential. I'm not here to bash bookkeepers. They give you a crystal-clear, audited picture of where you’ve been—every transaction, every expense, every dollar of revenue, perfectly recorded. It's your rearview mirror, and it's legally required.

But when you need to decide which turn to take up ahead? That historical data on its own is useless. This is where financial planning and analysis storms in and saves the day.

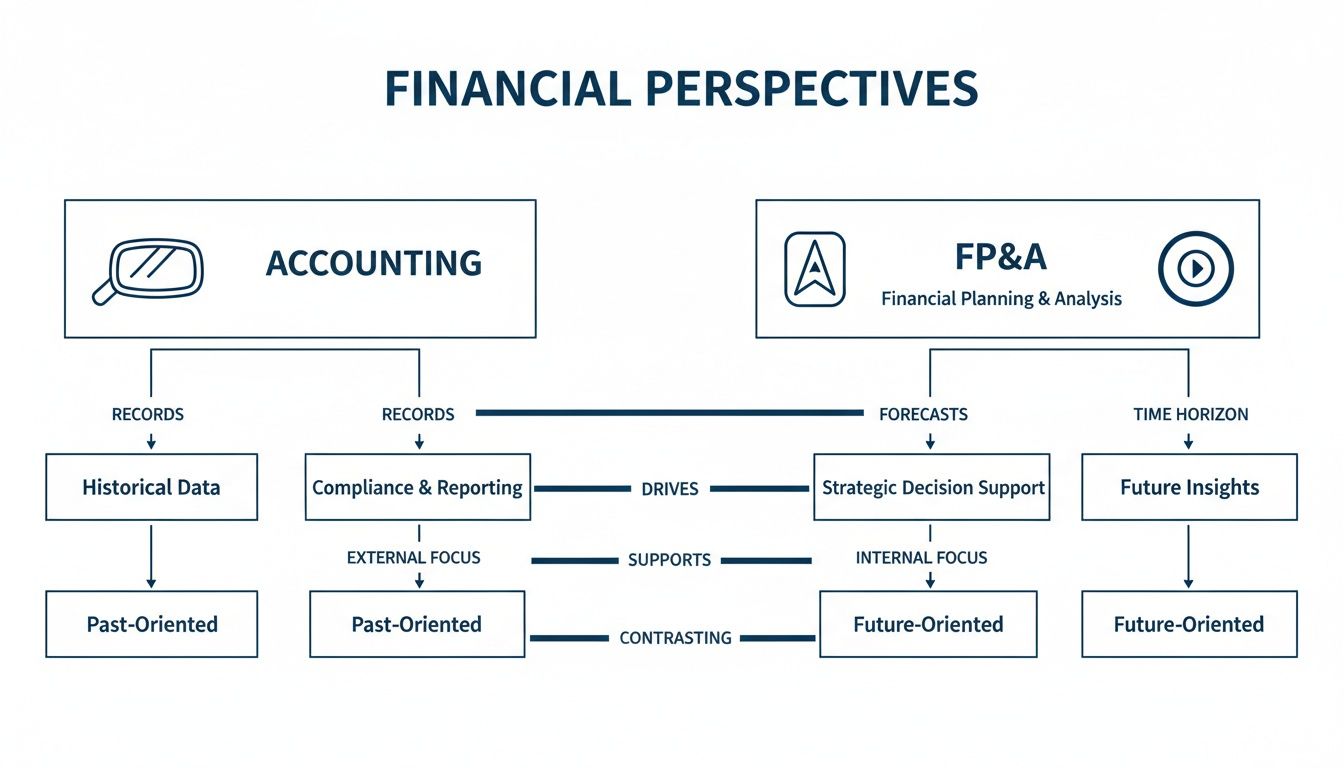

To put it bluntly, FP&A looks at the past to predict the future. Accounting just looks at the past.

Here's the cheat sheet.

This table nails the difference between the backward-looking scorekeeper (accounting) and the forward-looking strategist (FP&A).

| Aspect | Traditional Accounting | Financial Planning & Analysis (FP&A) |

|---|---|---|

| Time Focus | Backward-looking (historical) | Forward-looking (predictive) |

| Main Goal | Record and report past financial transactions accurately | Plan, forecast, and guide future financial performance |

| Key Output | Financial statements (Balance Sheet, Income Statement) | Budgets, forecasts, scenario models, variance reports |

| Questions Answered | "What happened last quarter?" | "What will happen next quarter?" and "What if…?" |

| Primary Role | Scorekeeper | Strategic Partner / Coach |

While accounting gives you the hard numbers for compliance, FP&A turns those numbers into a goddamn roadmap.

FP&A takes that pristine accounting data and builds a financial GPS for your company. It’s the forward-looking function that helps you answer the questions that actually keep you up at night:

Without solid answers, you’re just guessing. You’re making high-stakes decisions on gut feelings and stale data, which is a fantastic recipe for disaster. FP&A gives you the models, forecasts, and "what-if" scenarios that turn your gut feeling into a data-backed strategy.

Think of it this way: Accounting is the scorekeeper, meticulously recording the game that just happened. FP&A is the coach, using those stats to draw up the winning play for the next quarter.

This shift from reactive scorekeeping to proactive strategy is why the FP&A solutions market is blowing up, projected to hit $17,807.2 million by 2033. Cognitive Market Research notes that companies are finally waking up to the fact that you can't navigate today's market by looking backward.

For a founder, understanding this isn't just for your CFO. It’s the difference between being a passenger and being the pilot who’s actually in control.

If you're looking for that expert co-pilot to help you steer, our guide on finding the right fractional CFO services is a damn good place to start.

So, FP&A is your company's financial GPS. Great. But what does that mean on a Tuesday afternoon when you’re staring down a payroll deadline and a nervous investor email? What does an FP&A team actually do?

Forget the dry textbook definitions. I’ve seen this built from scratch, and it all boils down to four core activities that separate the companies that thrive from those that just tread water. Get these right, and you're building a predictable, scalable business. Get them wrong, and you're just gambling with more zeros.

This visual hammers home the point: one side tells you what happened, the other helps you decide what happens next.

It’s a simple but powerful distinction. Now, let's get into the weeds.

Let’s be honest: most company budgets are dead on arrival. They’re a work of fiction created in a frantic Q4, approved in January, and completely ignored by February. That’s not budgeting; that’s corporate theater.

Real budgeting and forecasting is about creating a living, breathing financial map. It’s not a static document you set and forget. It’s a dynamic model that connects your lofty goals (like "launch in a new market") to the gritty realities on the ground (like "hire three new sales reps at $X salary").

It's the blueprint for your year. But a good blueprint has rolling forecasts—updated monthly or quarterly—that adjust the plan based on what’s actually happening. Marketing campaign blew up? Great, let's reallocate funds to double down. Key hire fell through? Okay, let's adjust our revenue targets and expense line. It’s about agility, not rigidity.

This is where FP&A really earns its keep. Scenario planning is your "what-if" machine. It’s the process of modeling different potential futures so you’re not caught with your pants down when reality inevitably throws a punch.

A good FP&A analyst doesn't just give you one forecast; they give you three: the one you hope for (best-case), the one you expect (base-case), and the one that keeps you up at night (worst-case).

This isn't about pessimism; it's about being prepared. What happens to our cash runway if our biggest client churns? How does a 20% spike in supply chain costs impact our gross margins? Can we survive a recession if sales drop by 30% for six months straight?

Running these scenarios before they happen is the difference between making a panicked, emotional decision and executing a pre-planned playbook. It turns potential catastrophes into manageable challenges.

The quarter is over. You either crushed your numbers or you missed them. Now what? The million-dollar question is: why?

Variance analysis is the detective work that uncovers the story behind the numbers. It’s the process of comparing your actual results to what you budgeted and digging into the differences (the "variances").

It’s never enough to say, "We missed revenue by $100,000." A sharp FP&A pro asks the follow-up questions:

This isn’t about pointing fingers. It’s about finding the leaks so you can fix them, and finding the fires so you can pour gas on them. Without it, you’re doomed to repeat the same mistakes, quarter after quarter.

Finally, all this incredible analysis is worthless if it stays locked in a spreadsheet. The fourth pillar, management reporting, is about turning raw data into a compelling story that drives action.

This is not about dumping a 50-page report on someone’s desk. It's about creating concise, visual dashboards and summaries that give leadership the exact information they need to make smart, fast decisions.

A good management report doesn't just present data; it provides insight. It highlights trends, flags risks, and answers the "so what?" behind every chart. It’s the final, critical step that turns FP&A from a back-office chore into a true strategic partner.

Alright, let's talk tools. You don't need a million-dollar software suite to get started, but using the wrong tool for your stage is like trying to build a house with only a screwdriver—painful, slow, and guaranteed to be wobbly.

I've seen founders try to brute-force this, and it always ends in a very expensive mess. Let’s build your toolkit the smart way.

Every FP&A journey begins with a spreadsheet. Excel, Google Sheets—it doesn't matter. For an early-stage company, it’s the perfect sandbox. It’s flexible, free, and lets you build a decent three-statement financial model before your coffee gets cold.

But this hero has a dark side. As you grow, that beautiful, simple spreadsheet mutates into a monster. A 37-tab file with conflicting versions and formulas so complex they could achieve sentience.

The breaking point looks like this:

Spreadsheets are a fantastic start. But the moment you have multiple people touching the financial plan, it's time to graduate.

This is where dedicated FP&A platforms like Anaplan, Planful, or Jedox enter the chat. Think of them as spreadsheets on steroids, built for the chaos of a scaling business.

What do they really do that a spreadsheet can't? They create a single source of truth. Instead of a dozen disconnected files, everyone from finance to sales works from the same real-time data. It’s a game-changer.

These platforms are built for the heavy lifting:

The investment is real, no doubt. But when you’re making multi-million dollar decisions, doing it on a fragile spreadsheet is a risk you just can’t afford.

Now for the fun part. AI is no longer a buzzword; it’s a genuine co-pilot for FP&A teams. We're not talking about robots taking over finance jobs. We're talking about AI automating the 80% of grunt work analysts hate, freeing them up for the 20% that requires a human brain—strategy.

AI in FP&A is about augmenting your team, not replacing it. It’s the tool that finally lets your finance experts stop being data janitors and start being strategic advisors.

AI-powered tools can scan millions of data points to spot trends a human might miss, generate baseline forecasts with startling accuracy, and flag weird expenses before they become a problem. The financial planning software market is projected to grow by $15.94 billion between 2026 and 2030, driven by this exact need. You can read the full analysis on the financial planning market to see how fast this space is moving.

Your toolkit should evolve with you. Start with spreadsheets, graduate to a dedicated platform, and start looking for talent who can wield these new AI tools. That’s how you build a finance function for the future, not the past.

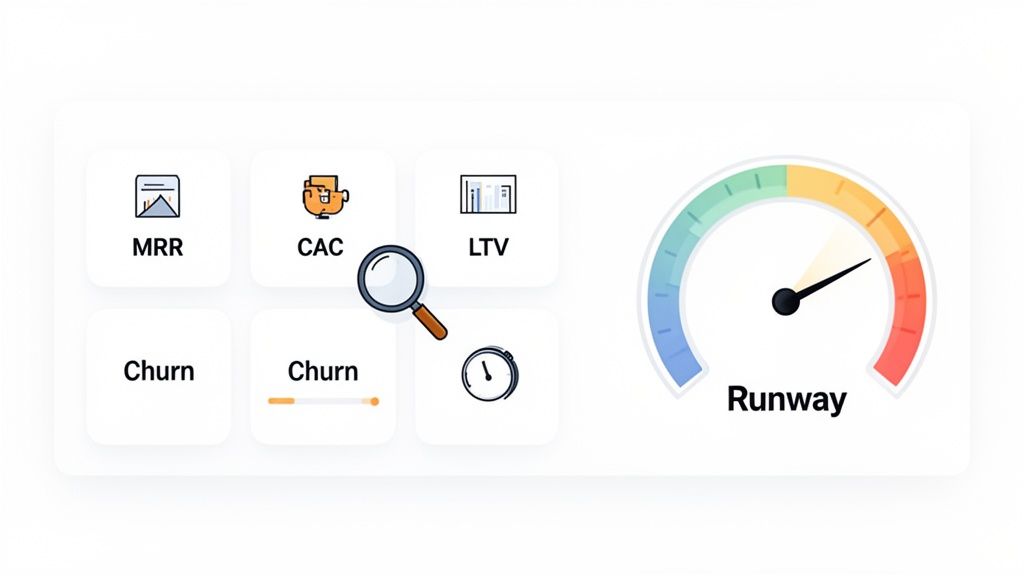

Let's get down to the cold, hard numbers. A solid FP&A function isn't about building fancy spreadsheets; it's about being brutally honest about what's working and what's bleeding you dry. It's easy to get caught up in vanity metrics like website traffic or total sign-ups. They feel good, but they don't pay the bills—they're the sugar high of the startup world.

Real FP&A cuts through the noise. It focuses on the handful of metrics that tell the true story of your business's health. Get these wrong, and you might as well be rearranging deck chairs on the Titanic. Get them right, and you can spot the iceberg from miles away.

Here are the KPIs your FP&A team needs to be obsessed with.

If you track only two metrics, make it these. Customer Acquisition Cost (CAC) is what you spend to land a new customer. Lifetime Value (LTV) is the total revenue you can expect from them.

The magic is in the ratio. The LTV:CAC ratio is the ultimate gut check for your business model. It answers the most fundamental question: are you spending money to make money, or are you just lighting cash on fire?

Ignoring this is a classic rookie mistake. It’s how companies with millions in revenue suddenly go broke.

For any subscription business, Monthly Recurring Revenue (MRR) is your lifeblood. It's the predictable revenue that lets you sleep at night (or at least try to).

But MRR has an evil twin: churn. Churn is the percentage of customers who cancel. Think of it as a leaky bucket constantly draining your revenue.

You can have skyrocketing MRR growth, but if your churn is too high, you’re just running on a treadmill. You have to run faster and faster just to stay in the same place.

A "good" churn rate varies, but for most SaaS businesses, anything over 5-7% annually should set off alarm bells. A great FP&A analyst doesn't just report the number; they dig into why. Are new customers leaving after three months? Is one specific feature causing rage-quits? This is where analysis drives strategy. For more on turning data into actionable stories, check out our guide on financial reporting best practices.

Now for the big ones. The survival metrics.

Cash Flow Forecasting: Forget profit. Profit is an opinion, cash is a fact. A cash flow forecast predicts the actual dollars flowing in and out of your bank account. It's the most critical tool for avoiding that dreaded "out of cash" moment.

Runway Analysis: Based on that forecast, your runway is the number of months you have left until you run out of money.

This isn't a "nice-to-have" report. It is the single most important number for any startup. It tells you when you need to raise money, when you have to cut costs, or when it’s time to make a painful pivot.

FP&A provides the discipline to track these relentlessly. It’s the function that stops you from lying to yourself, your team, and your investors. It replaces wishful thinking with a concrete plan.

Spending your weekends wrestling with financial models instead of running your company? Congratulations, that’s your first sign. But hiring your first FP&A person is a huge step. It feels like admitting your simple startup is turning into a complex beast.

Hire too early, and you're burning cash on a salary that could've gone to an engineer. Hire too late, and you’re flying blind, making critical decisions on gut instinct when you need a map. So, when do you pull the trigger?

It’s not about a magic revenue number. It’s about complexity. The signals are usually screaming at you long before you listen.

You don’t just wake up one day and need an FP&A analyst. The need creeps in.

When your financial questions take more than a few hours to answer, you've waited too long. The cost of a bad decision made from bad data is always higher than the cost of getting the right help.

Okay, so you need help. You post a job for a "Financial Analyst" and brace yourself. First comes the sticker shock. A good FP&A analyst commands a six-figure salary, plus benefits, plus equity. You’re looking at a $100k-$150k+ annual burn.

Then comes the hiring process. Hope you enjoy spending your afternoons fact-checking resumes and running technical interviews on three-statement modeling. It's a slow, painful grind to find someone with the technical chops who also understands the beautiful chaos of a startup.

This traditional path is a terrible one for most growing companies. You need the expertise, but not the full-time cost—not yet.

So what’s the alternative to mortgaging your office ping-pong table for one analyst? You find pre-vetted, expert talent you can actually afford. This isn't about finding a cheap bookkeeper; it's about getting senior-level FP&A brainpower without the crippling overhead.

The game has changed. You can tap into a global talent pool of skilled professionals who can build your models, run your forecasts, and deliver the insights you need for a fraction of the cost. Think of it as FP&A-as-a-service.

And these days, that talent needs to be tech-savvy. Organizations using AI in FP&A report 65% satisfaction with their forecast quality, compared to just 42% for those sticking to old-school methods. You can discover more insights about AI in FP&A to see how crucial these modern skills are.

The right hire is a force multiplier, not just a cost center. For founders ready to make smarter decisions without breaking the bank, exploring platforms with pre-vetted remote financial analysts is the most logical next step. It's how you get the GPS without having to buy the whole car.

Let's wrap this up. After years in this world, I've heard every question imaginable about financial planning and analysis. Here are the straight-up answers you need.

I know, we covered this, but it's the big one. Let's try an analogy.

Your accountant is the historian. They look backward, meticulously recording what has already happened to create a clean, compliant record of the past. It's foundational.

Your FP&A team is your navigator. They stare out the front windshield, using the historian's data as a starting point. They combine it with market trends and business plans to build a map of where you're headed.

Simply put: Accounting tells you if you hit your numbers last quarter. FP&A tells you how to hit your numbers for the next four.

That’s a myth that costs early-stage founders a lot of money and sleep. For a startup, FP&A boils down to one crucial thing: survival.

It’s about knowing your cash runway down to the day. It’s about modeling the impact of hiring that new marketing lead before you send the offer letter. Big companies use FP&A to optimize by a few percentage points; startups use it to avoid driving full-speed into a brick wall they never saw coming.

Thinking FP&A is only for large enterprises is like thinking only professional athletes need a game plan. The stakes are just as high when you're starting out—arguably higher, because you have zero margin for error.

Yes, you can. And for a while, you absolutely should. Excel is the perfect sandbox for your first financial model. It's flexible and powerful enough for the early days.

But as you scale, that trusty spreadsheet shows its cracks. It becomes a fragile beast where one fat-finger error can silently derail your entire forecast. Version control becomes a nightmare ("Is this 'Financial_Model_v4_FINAL_JohnsEdits_USE_THIS_ONE.xlsx' the right one?").

So yes, use Excel to get off the ground. But recognize it for what it is: a launchpad, not your long-term mission control.

Ready to skip the six-figure salary and hiring headaches? HireAccountants gives you access to pre-vetted, expert financial analysts who can build your models, run your forecasts, and give you the strategic insights you need to grow—all for a fraction of the cost of a full-time hire. Find your expert FP&A talent in as little as 24 hours.

Let's simplify your finances today!