Let’s get one thing straight about CFO services for small business: this isn’t about bringing in a stuffy, six-figure executive to lecture you about office supply spending. It’s about renting a strategic financial brain to help you stop running your business blindfolded through a minefield. Which, if we're being honest, is how most of us operate in the early days.

As a founder, you're probably making huge decisions based on two key data points: your current bank balance and a strong gut feeling. It’s the classic startup cocktail, and it works—right up until it spectacularly doesn't. You’re likely flying blind, celebrating that awesome new revenue milestone while a dozen tiny, invisible leaks are quietly sinking your profitability.

Sound a little dramatic? I once worked with a founder who threw a huge party to celebrate a record sales month. Champagne was flowing, backs were patted. A couple of weeks later, a painful financial deep dive revealed his cost of goods sold was so wildly miscalculated that he was actually losing $3.50 on every single sale. He had successfully sold his way right into a massive cash flow crisis.

This isn't a scare tactic. It's a pattern I've seen over and over.

Most small businesses don’t implode from one big, catastrophic event. They die from a thousand tiny cuts. Here are the usual suspects draining the lifeblood from your company:

This is where the difference between a bookkeeper and a CFO becomes crystal clear. Your bookkeeper is your financial historian; they meticulously record what you’ve already spent. They can tell you with perfect accuracy how much money you lost last quarter. (Great, thanks.)

A bookkeeper tells you where your money went. A CFO tells you where your money should go next to actually build a valuable, sustainable company. They’re playing chess while everyone else is just playing checkers with the receipts.

You need a forward-looking strategy, not just a backward-looking report card. If you're tired of reacting to financial fires, it's time for a change. Understanding the benefits of outsourcing accounting services is the first step in seeing how all the pieces of the puzzle fit together, and it's how you finally start plugging those leaks for good.

Forget the stuffy, corner-office executive you see in movies. For a small business, "CFO services" isn't about hiring a six-figure suit to intimidate your team. It’s about something much more practical.

Think of it like this: your bookkeeper is a historian, meticulously recording every financial event that has already happened. They tell you where your money went. It’s crucial work, but it’s all looking in the rearview mirror.

A CFO, on the other hand, is your financial co-pilot. They sit in the passenger seat, looking at the road ahead, helping you navigate the twists, turns, and potential roadblocks. They’re focused on where your money is going.

So, what does that forward-looking guidance actually involve? It’s not some secret spreadsheet formula. It’s about replacing gut-feelings and late-night anxiety with data-backed decisions.

A great CFO service builds the financial engine your business needs to grow, focusing on three key areas:

For a long time, only big corporations could afford this level of strategic financial talent. That's changing, fast. Most small business owners can't justify a $250,000 to $400,000 annual salary for a full-time CFO. Turns out there’s more than one way to hire elite financial talent without mortgaging your office ping-pong table.

The modern solution? Outsourced and fractional models. Instead of the massive full-time cost, companies can now pay $3,000 to $10,000 per month for top-tier expertise, saving up to 90%. You get the brainpower you need, for the exact number of hours you need it. For more on this trend, check out these cost-saving CFO insights from swatadvisors.com.

A good CFO service doesn’t just hand you reports. They give you opinionated advice. They’re the one person who will tell you, respectfully but directly, that your brilliant new idea is a financial disaster waiting to happen.

At the end of the day, they bring the financial discipline you simply don't have the time to develop yourself. You’re busy being the visionary, the lead salesperson, and the chief innovator. Bringing in a CFO isn’t a sign of weakness; it’s one of the smartest strategic moves a founder can make.

To see exactly how this flexible approach works in practice, our guide on fractional CFO services breaks it down even further.

Alright, let's talk about choosing your financial co-pilot. Not all CFO services are created equal, and you definitely don’t need a bazooka to kill a fly. Bringing in a CFO isn't a one-size-fits-all solution; it's about matching the right expertise to your specific growing pains.

Think of it like this: you wouldn't hire a full-time personal chef just because you need a decent meal on Tuesday night. Sometimes you need a caterer for a big event, and sometimes you just need a solid recipe to follow. Picking the right CFO service is the same—it’s about finding the right fit for your business right now.

Making a bad choice here is more than just frustrating. It’s expensive. You could end up paying for high-level strategy when all you needed were better financial controls, or you might hire a project-based expert for an ongoing scaling problem that requires consistent oversight.

First up is the Fractional CFO. This is your long-term, part-time strategic partner. They're not on your full-time payroll, but they’re deeply embedded in your business, typically working a set number of hours each week or month.

This model is perfect for businesses hitting that awkward growth stage—somewhere between $1M and $10M in revenue. You're too big to keep winging it but not quite ready to commit to a $250,000 executive salary.

A fractional CFO becomes part of your leadership team. They’re in your strategy meetings, they challenge your assumptions, and they help you build a financial roadmap for the next 12-24 months. They are the ones who tell you why the numbers are what they are, and what to do about it next quarter.

Your Fractional CFO is less like a consultant and more like a seasoned board member you can actually afford. They’re invested in your long-term success, not just a one-off project.

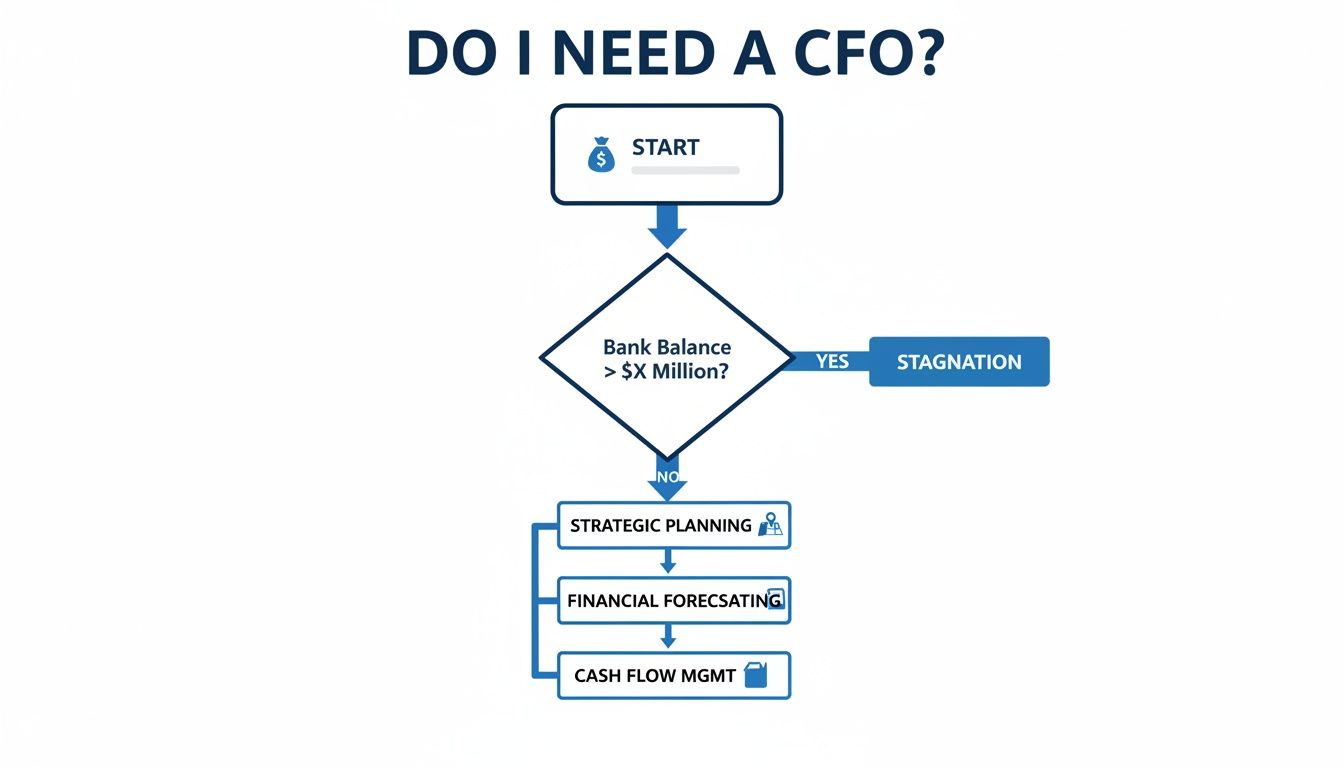

This decision tree can help you determine if you need to move beyond your bank balance for key decisions, pointing you toward strategic planning and cash flow management—the core of a CFO's role.

As the flowchart shows, relying solely on your bank account is a path to stagnation; a forward-looking approach is essential for growth.

Next, we have Outsourced CFO Services. This is a different beast entirely. It’s less about one person and more about an entire team. When you engage an outsourced service, you’re often getting access to a CFO, a controller, and bookkeepers all under one roof.

This is the ideal choice if your entire finance function is a mess. You’re not just lacking strategy; you’re lacking reliable systems, processes, and reporting. You need someone to come in, clean up the chaos, and run the whole show for you.

An outsourced firm handles everything from bookkeeping and payroll to high-level forecasting and board reporting. It’s a turnkey solution for founders who want a professional finance department without the headache of building and managing it themselves. The trade-off? It can feel a bit less personal than having a dedicated fractional CFO who knows the ins and outs of your team dynamics.

Finally, there’s the Project-Based CFO. This is your specialist, your hired gun. You bring them in for a specific, time-sensitive mission with a clear start and end date.

Common missions for a project-based CFO include:

You don’t need them forever; you just need their specialized expertise to get you across a critical finish line. It’s the most targeted and often the most cost-effective option for solving a single, high-stakes problem.

To make sense of these options, it helps to see them side-by-side. Each model offers a different blend of cost, integration, and focus.

| Model | Best For | Typical Cost | Level of Integration |

|---|---|---|---|

| Fractional CFO | Businesses needing ongoing strategic guidance without the full-time cost. Ideal for scaling companies ($1M-$10M). | $3,000 – $10,000+ per month | High: Acts as a part-time member of the executive team. |

| Outsourced CFO Service | Companies needing a complete, managed finance function, from bookkeeping to strategy. | $5,000 – $15,000+ per month | Medium: An external team that manages your finance department. Less personal. |

| Project-Based CFO | Businesses facing a specific, one-time financial event like fundraising, M&A, or a system overhaul. | $150 – $400+ per hour (or fixed project fee) | Low: Deeply involved for a short, defined period. In and out. |

Ultimately, the right choice boils down to where you are now and where you want to go next. Are you looking for a long-term navigator, a full-service crew to run the engine room, or a specialist to get you through a storm? Answering that question is the first step.

Every founder hits a wall. It’s that stomach-dropping moment when you realize your gut—the same intuition that got you off the ground—is now leading you straight into a fog. Making decisions based on your bank balance and a hunch is fine for a while, but eventually, that strategy runs out of road.

How do you know when you’ve hit that point? The signs aren’t subtle. They’re the financial headaches that keep you up at night, the questions you can't answer, and the nagging feeling that you’re flying blind at an altitude where a mistake could be fatal. This isn't just about growing pains; it’s about your business outgrowing your ability to manage its financial complexity alone.

This is the classic founder trap. Your sales charts are pointing up and to the right, you're hiring people, and everything feels successful. But when you look at the bottom line, there’s… nothing. Or worse, you’re somehow losing money.

It’s a slow-motion disaster. You’re so focused on chasing revenue that you miss the fact that your costs are scaling even faster. You might be experiencing this if:

This isn’t just bad luck; it’s a symptom of a business without a financial strategy. You're driving a faster car with no one looking at the fuel gauge.

Remember last month when you almost missed payroll? Or that unexpected tax bill that felt like a punch to the gut? If you’re constantly surprised by cash shortages, your intuition has officially failed you.

A business without cash flow forecasting is like a ship without a rudder. You’re at the mercy of every current, reacting to crises instead of anticipating them. A solid cash flow projection isn’t just a nice-to-have spreadsheet; it’s the early warning system that tells you a storm is coming in 90 days, giving you time to prepare.

Constantly reacting to cash emergencies is a sign you're no longer running your business—it's running you. You’re playing defense with your bank account instead of offense with your strategy.

For growing businesses, this is where fractional CFO services for small business have become a game-changer. Especially for companies hitting the $1-2 million monthly revenue mark, strategic leadership is critical, but a $200,000+ full-time salary is out of the question. Instead, for $3,000-$7,000 per month, you get an expert who manages forecasting, investor reporting, and financial modeling, ensuring you never get blindsided again. You can learn more about how fractional CFOs are reshaping business finance and see if it's the right fit.

If the thought of building a financial model for investors makes you break out in a cold sweat, it’s a sign. If you can’t explain your churn rate or inventory turnover without fumbling, it’s a sign. These aren’t just numbers; they’re the vital signs of your business. And when you can’t read them, you need a doctor, fast.

Okay, so you're sold. It's time to swap gut feelings for a genuine financial strategy. But the idea of hiring a "CFO" probably feels a bit daunting—like you're about to start interviewing people who wear much nicer suits than you do.

Let's cut through that noise. This is your playbook for finding and vetting the right financial partner, all without having to sell the office ping-pong table. We’re skipping the generic "look for a team player" advice and getting right to what works.

Finding the right person isn't about locating someone who's just good with spreadsheets. You're searching for a co-pilot, not just a passenger. The demand for true financial strategists is soaring; in 2025, global CFO appointments hit a seven-year high, up 12% above the long-term average. This trend highlights a new reality where CFOs drive growth with data and forward-looking tools, not just old reports. You can dig into more on the rising stakes in financial strategy at russellreynolds.com.

Here’s what really matters when you're hiring:

Your goal in an interview is to see how they think, not just recite what they know. Ditch the standard questions and get to the heart of what makes someone a great strategic partner.

Try these on for size:

So, where do you find this magical unicorn of a CFO? You could spend months sifting through résumés and paying hefty recruiter fees. Or, you could just skip the line.

This is where we give ourselves a little pat on the back (toot, toot!). We built HireAccountants precisely because the old way of hiring is broken, slow, and ridiculously expensive for small businesses.

Instead of starting from zero, you get instant access to a marketplace of pre-vetted, top-tier financial talent from Latin America.

The platform immediately shows you the caliber of talent available—specialists in everything from FP&A to strategic financial management.

This approach gives you the strategic firepower of a seasoned CFO for a fraction of what a US-based hire would cost, often saving you up to 80%. It’s the ultimate arbitrage opportunity: top-tier skill without the top-tier price tag. For founders who need temporary leadership during a critical growth phase, you can learn more about how interim CFO services provide this exact flexibility.

We’ve covered a lot of ground, haven't we? From the slow, painful leaks that can drain a startup’s bank account to what CFO services for a small business really mean (it’s so much more than spreadsheets). We've even looked at how you can get that top-tier expertise without having to sell off the office ping-pong table.

Let’s boil it all down to one simple, unavoidable truth. Running a business on gut feelings and sheer hope is a recipe for disaster. It might get you off the launchpad, but it’s not the fuel you need to reach the next orbit.

Think about the businesses that truly make it—the ones that scale into profitable, resilient companies versus those that fizzle out in a cycle of cash flow emergencies. The difference, almost every time, is strategic financial leadership. You’ve worn every hat imaginable: the visionary, the lead salesperson, the head of HR. Now, it's time to bring a financial strategist into your corner.

For a long time, this kind of high-level financial guidance felt like a luxury reserved for the Fortune 500 club. That era is over. Today, expert financial strategy isn’t some expensive indulgence; it's an accessible, affordable tool that gives you a serious competitive advantage. It's the key to shifting from constantly putting out fires to proactively building the future you want.

You don't need a massive budget to make brilliant financial decisions—you just need access to the right mind. The rules of the game have changed, and the smartest founders are taking full advantage.

Bringing a CFO into your world means you can finally:

This isn’t about losing control of your company. It’s about gaining more control than you’ve ever had by truly understanding the engine that drives your business.

Ready to trade the guesswork for a clear strategy? The way forward is more straightforward and affordable than you probably think. You can explore the pre-vetted, elite CFO-level talent on HireAccountants right now. See for yourself how a smart investment in strategic guidance can deliver a massive return and finally give your business the financial horsepower it deserves.

Alright, let's tackle some of the most common questions that come up when founders start thinking about CFO-level support. You’ve probably got a few of these on your mind right now.

I hear this one all the time. It’s easy to group all high-level finance roles together, but a controller and a CFO operate in completely different orbits.

Think of your controller as the master of your financial past. Their world revolves around historical accuracy. They make sure the books are pristine, the financial statements are airtight, and all your compliance boxes are checked. A controller tells you, with total precision, exactly what happened last month.

Your CFO, on the other hand, is the architect of your financial future. They take all that perfect historical data and ask, "So what? Where do we go from here?" A CFO builds the financial models that stress-test your big ideas, challenges your assumptions, and tells you when to floor it or ease off the gas.

Simply put, the controller looks backward to guarantee accuracy, while the CFO looks forward to drive growth. You absolutely need both functions, but one can't do the other's job effectively.

This is a perfectly valid question. As an entrepreneur, you live and breathe ROI. But unlike a paid ad campaign, the return on a great CFO doesn't show up as a single, neat metric on a dashboard. It’s measured in the expensive mistakes you don't make and the lucrative opportunities you finally seize.

You'll see the ROI pop up in a few key areas:

The truest ROI isn't just about the money you save or raise. It’s the immense value of knowing your business won't be blindsided by a cash flow crisis. The ability to sleep at night is priceless.

This is not a "send me a login and I'll email you a report" arrangement. For a CFO to truly make an impact, they need to get into the engine room of your business. Be prepared to grant them deep access to just about everything that touches a dollar.

This typically means:

It’s a significant level of trust, which is why the hiring process is so critical. You aren’t just hiring a contractor; you’re bringing a strategic partner into your company’s inner circle. If that level of transparency makes you uncomfortable, you might not be ready for a CFO.

Let’s set the right expectations here. A CFO isn’t a miracle worker who can triple your valuation overnight. The first 30 to 60 days are usually dedicated to discovery—a deep dive into your numbers, your business model, and the unique challenges you face. This is where they identify the most urgent fires.

You should start seeing the first tangible results—the "quick wins"—within 90 days. This could be a reliable cash flow forecast that finally ends the monthly surprises or a simple pricing adjustment that immediately boosts your gross margin.

The larger, more fundamental strategic improvements will take more time to bear fruit. But the feeling of clarity and confidence you get from having a true financial partner? You'll feel that almost right away.

Ready to stop guessing and start building a more profitable, predictable business? At HireAccountants, we connect you with pre-vetted, top-tier financial talent so you can get the strategic support you need at a price that makes sense.

Let's simplify your finances today!