Let's get one thing straight: finding the right accountant isn’t about just filling a seat. It's about finding a financial co-pilot. The process starts by figuring out what you actually need (a bookkeeper, a CPA, or a fractional CFO), then tapping into specialized platforms to find pre-vetted talent who gets your mission. Forget the old playbook. It’s time for a new one.

Be honest. Your current method for finding an accountant is probably a dumpster fire. You toss a job description onto LinkedIn, ask your network if they "know a guy," and then drown in a sea of résumés that all look suspiciously identical.

You’re basically crossing your fingers and hoping for a miracle while your cash flow gets murkier and your board starts asking pointed questions. It’s not your fault. The old way of doing things is officially dead.

Here's the painful truth: qualified accountants are now rarer than a bug-free software launch. I’m not being dramatic. The US has lost over 340,000 accountants in the last five years. It's a full-blown talent crisis.

This isn't just a small dip; it's a seismic shift that leaves you fighting over a rapidly shrinking pool of experts.

That $80k salary you budgeted last year? Yeah, good luck with that. The game has changed, and the odds are stacked against you. So you get stuck in the same frustrating loop:

You’re not just looking for someone who can use a calculator. You need a financial partner who can guide you through audits, investor diligence, and the ninth circle of hell that is payroll compliance. The stakes are way too high for wishful thinking.

Hope you enjoy spending your afternoons fact-checking résumés and running technical interviews—because that’s now your full-time job. Hiring the wrong person isn’t just an inconvenience; it’s a direct threat to your runway.

A "good enough" accountant leaves you with messy books, missed tax deadlines, and flawed financial models that will absolutely vaporize investor confidence. It’s time to stop praying to the LinkedIn gods and start using a system built for today's reality.

Before you get lost in the weeds, take a minute to browse the profiles of pre-vetted accountants at https://hireaccountants.com/accountants/ to see what top-tier talent actually looks like. This isn’t about placing blame; it’s about admitting the old system is broken so we can finally fix it.

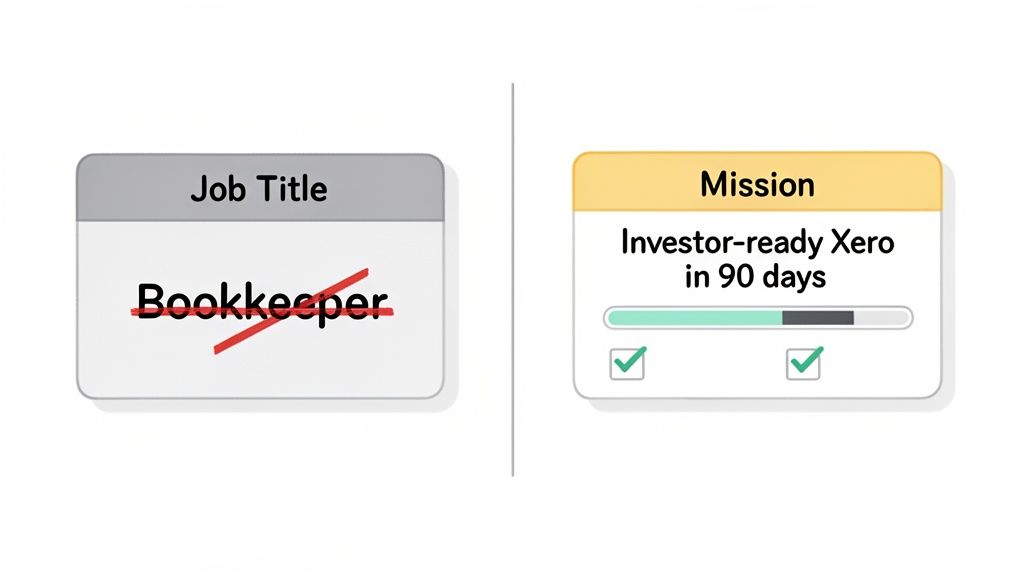

Before you write a single word of a job description, stop. Ask yourself one blunt question: what dumpster fire are you actually trying to put out?

"Bookkeeper" is a label. "Get my chaotic Xero account investor-ready in 90 days" is a mission. One attracts anyone with a pulse and a QuickBooks certificate; the other attracts a genuine problem-solver who understands what’s at stake.

Nail this down first, or you'll hire someone who looks great on paper but is completely wrong for your business. It’s like hiring a meticulous CPA to do simple data entry—an expensive, messy waste of their talent and your money.

Get specific. "Help with accounting" is useless. Think in outcomes. What do you need to happen?

Knowing the why is the only way to find the right who. And you have to be sharp about it. A staggering 83% of CFOs are scrambling to find qualified talent, with an estimated 124,200 US openings every year. You can’t afford to be vague. You can learn more about the talent crunch from this Ramp analysis.

Once you’ve defined your mission, you can pinpoint the professional you need. Forget the formal titles for a second and focus on the function.

Your goal isn't just to fill a seat. It's to hire the precise expertise needed to solve your most pressing financial problem without mortgaging your office ping-pong table for skills you don't need.

Here’s a no-fluff breakdown:

Starting with the mission gives you a crystal-clear picture of who you're looking for. That clarity doesn't just make for a better job post; it becomes the foundation for your entire vetting process.

Let's talk money. And not just salary. The sticker price of an accountant is a tiny piece of a much larger—and often uglier—puzzle.

If you think finding an accountant is just about their hourly rate, you’re in for a nasty surprise. The real cost includes recruiter fees, payroll taxes, benefits, software licenses, and the time you burn getting them up to speed. And that's before we talk about the catastrophic expense of a bad hire.

Hiring a full-time, in-house CPA in the US feels like the gold standard. Secure, dedicated, and just down the hall. It’s also eye-wateringly expensive. A decent staff accountant commands $70k-$100k, and that’s just the starting line.

Once you add the extras, the number balloons:

Suddenly, your $80k accountant is a $115k hit to your burn rate. For most startups, that’s a crippling expense.

Okay, so a full-time hire is out. You pivot to a freelance marketplace, lured by the siren song of $15/hour bookkeepers. Seems like a bargain, right? Wrong. You’re trading one problem for a whole new set of frustrations.

Welcome to the world of unpredictable quality, timezone chaos, and communication black holes. You'll spend more time project managing and fixing their mistakes than you would have spent doing it yourself. A cheap hire who botches your books isn't a cost-saver; they're a liability in disguise.

There’s a much smarter way. Tapping into global talent pools offers a middle ground that slashes costs without sacrificing quality. The accounting shortage in the US is very real, but it’s not a global problem.

Smart founders aren't just looking for the cheapest option. They're looking for the best value—top-tier talent that doesn't obliterate their runway. It’s about being resourceful, not reckless.

The savings are staggering—businesses often slash labor costs by 50-70% by looking beyond US borders. A traditional CPA role costing over $100k stateside can be filled with an equivalent expert for under $36,000. That’s a game-changer. For a deeper look, check out the future of accounting outsourcing.

Platforms that curate pre-vetted, English-fluent professionals from nearby time zones give you the best of both worlds. You get seasoned expertise without the six-figure price tag. It’s the kind of move your runway will thank you for.

| Hiring Model | Average Annual Salary/Cost | Hidden Costs | Hiring Speed | Verdict |

|---|---|---|---|---|

| In-House US Hire | $80,000 – $115,000+ | Benefits (~30%), recruiting fees (15-25%), overhead, payroll taxes | 2-4 Months | The most expensive option by a mile. Total control, but at a huge cost. |

| US Freelancer | $40 – $150/hour | Unpredictable hours, platform fees, risk of rework, management overhead | 1-4 Weeks | A short-term fix at best. Quality is a total gamble. High management tax. |

| Global Talent Platform | $25,000 – $45,000 | Platform fees, but often includes compliance and payroll support | 1-2 Weeks | Highest value, hands down. Access to top-tier, vetted talent at a fraction of the cost. |

The numbers don't lie. While a full-time hire feels safe, a strategic approach to global talent offers a far more sustainable path to getting the financial expertise you need.

Ready to see what that actually looks like in practice? Check out our transparent pricing for pre-vetted accountants and see the math for yourself.

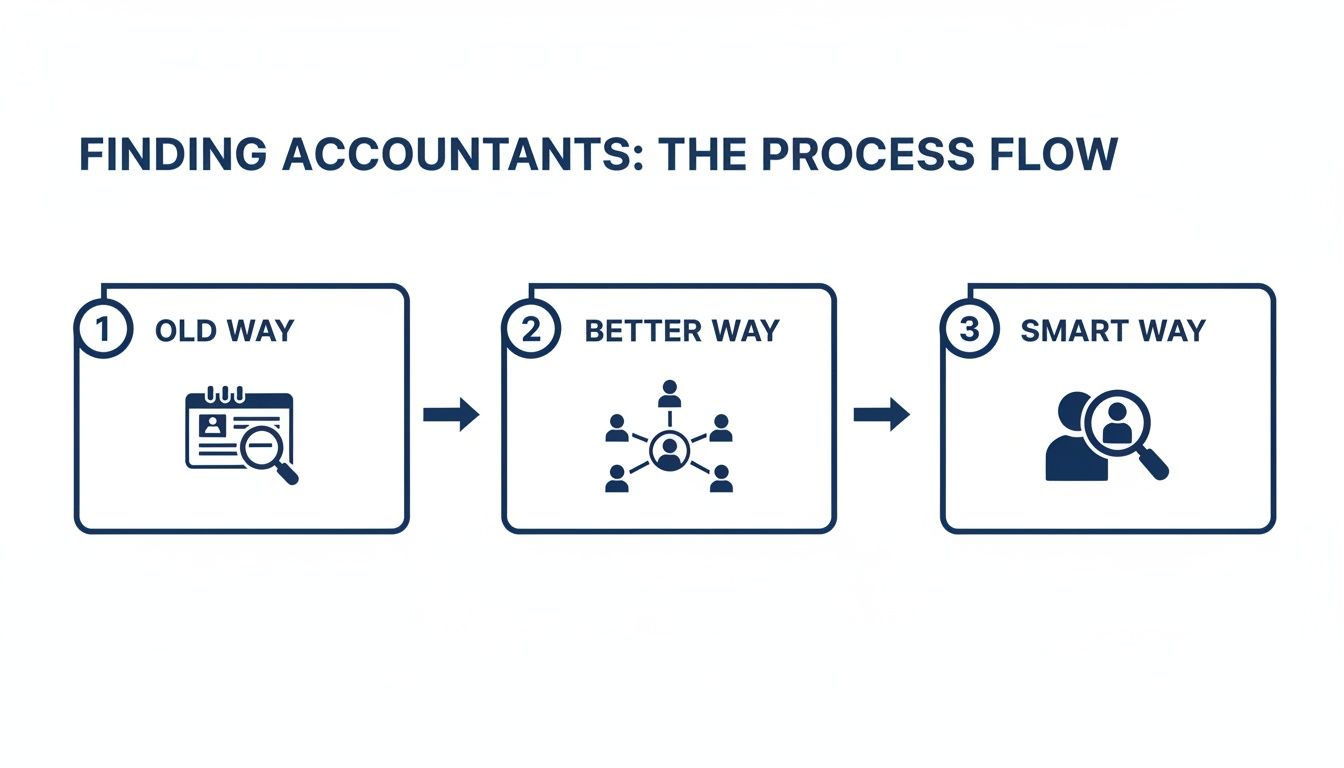

Alright, where do you actually find these people? If your game plan is to just throw a job post onto a massive board like LinkedIn and hope for the best, I’ve got bad news for you. The truly great accountants aren't scrolling through job feeds all day; they're busy adding value somewhere else.

You have to be smarter than just posting and praying. That's like trying to find a needle in a haystack that's also on fire.

Sure, you can go the traditional route. Sift through member directories on sites like the AICPA or try your luck in niche accounting groups on Reddit. But let's be honest, that’s a slow, manual slog. It’s the recruiting equivalent of going door-to-door.

You’ll burn weeks sifting through profiles, crafting outreach messages that get ignored, and trying to figure out if someone's "QuickBooks Pro" title actually means anything. It's a massive time sink with a pathetic success rate.

The point isn't just to find any accountant. It's to find the right accountant without the search becoming your new full-time job. A "post and pray" approach is a recipe for disaster.

This is where you stop hunting and start connecting. Specialized talent platforms are the ultimate shortcut to top-tier financial pros. Think of them less like a chaotic job board and more like a curated marketplace of vetted experts.

These platforms work for one simple reason: they do the most painful part of hiring for you. Instead of you personally vetting 100 applicants, they give you a pre-qualified shortlist of three to five people who are an actual fit.

Here’s why this approach is a game-changer:

This isn't about finding the cheapest person. It’s about finding the smartest path to the right person. You’re tapping into a system built to connect you with high-caliber talent who can start adding value from day one.

So, you’ve got a few promising candidates. Their résumés look sharp and you're starting to feel optimistic.

Slow down. This is where the real work begins—separating the talkers from the doers.

I've learned this the hard way. A charming interview means nothing if they can't balance a spreadsheet under pressure. I once hired a charismatic CPA who could talk a great game about GAAP but crumbled when I handed him a messy P&L. A total nightmare.

To avoid that, you need a battle-tested playbook that goes way beyond, "So, tell me about yourself."

The hiring journey has changed. We've moved from slow, old methods to smarter, more efficient ways of finding talent.

The takeaway? Stop casting a wide net and start using focused, intelligent sourcing. It’s the key to making faster, better hires.

Ditch the generic script. You need questions that reveal how candidates actually operate under pressure.

Here are a few of my go-to questions that cut through the fluff:

Their answers tell you everything. Are they panicked or methodical? Do they ask clarifying questions or just jump to conclusions? Do they take ownership or look for someone to blame? This is how you spot an A-player.

Asking a candidate if they know QuickBooks is like asking a surgeon if they know how to hold a scalpel. It's a useless question. You have to see them in action.

This means a practical skills test is non-negotiable.

Don't ask candidates to do free work on your live books—that’s a huge red flag and makes you look cheap. Instead, create a small, contained challenge in a sandbox environment that mimics a real task.

This isn't a trick. It's confirmation. Give them a sample set of bank transactions and ask them to reconcile an account. Or provide messy data and have them build a simple financial summary.

The test should take no more than 60-90 minutes. This one step will weed out 90% of candidates who look good on paper but lack real-world skills. It’s the single most effective thing you can do to de-risk your hire.

If you're wondering what skills to test for, our breakdown of different accounting roles is a solid starting point.

If you've ever hired an accountant the old way, you know the pain. You post a job, get buried in résumés, and spend weeks trying to figure out who actually knows what they're doing. It's a broken, expensive process.

There's a reason specialized platforms have emerged: the traditional model doesn't work for growing businesses anymore. It’s too slow, too risky, and too much of a time-suck for a founder who already has a full plate.

Imagine skipping all that. Instead of sifting through mismatched applications, what if you got a curated list of top-tier, pre-vetted accountants in as little as 24 hours?

That's the entire premise of a modern hiring platform. It replaces the haystack with a handful of pre-qualified needles. These services combine a deep talent pool with smart matching to connect you with the right pro, right away.

This isn't just about saving money, though the cost savings are huge. It’s about getting direct access to seasoned expertise without the six-figure salary or the administrative overhead. Toot, toot!

Think about it. The platform handles the tedious parts—screening, technical vetting, even payroll and compliance. You're not just hiring an accountant; you're plugging into a ready-made system that delivers value from day one.

The real advantage is peace of mind. You're not gambling on a stranger from a random marketplace. You're getting connected with professionals who have already been rigorously tested. It’s the closest thing to a hiring guarantee you'll ever get.

Let's cut to the chase with the questions I always get from founders right before they make their first finance hire.

Think of it this way: your bookkeeper is in the financial trenches, meticulously recording every transaction. Their job is to keep your data pristine.

An accountant takes that clean data and elevates it. They analyze it, prepare formal financial statements, and tell you what it all means. A bookkeeper ensures your history is accurate; an accountant helps you use that history to build a smarter future. You can’t have one without the other.

This is the big one, right? In the US, a full-time staff accountant will run you $70,000 to $100,000+ a year, before benefits. For a growing business, that’s a serious hit to your cash flow.

This is where global talent changes the game. You can find highly skilled, pre-vetted professionals in US-aligned time zones for a fraction of that. You have to stop thinking about a candidate's location and start focusing on their skills.

Don’t get stuck in the mindset that quality is tied to a local zip code. The best talent for your business might be thousands of miles away, ready to deliver incredible results without the six-figure price tag.

Honestly, the moment you start feeling overwhelmed by the numbers, you’re already late. A better signal is when you have consistent revenue, are juggling multiple invoices, or are thinking about raising capital.

Get your books in order early. It will save you from massive headaches and clean-up costs later. You don’t want to be scrambling when an investor requests due diligence. Be proactive, not reactive.

Absolutely, provided you have the right systems. This is less about where someone sits and more about the tools you use.

A professional remote accountant is an expert in security best practices. They live in secure cloud software, use strong password policies, and communicate through encrypted channels. Reputable marketplaces also vet their talent for integrity. Security is a process, not a location.

Stop wasting time with generic job boards. Connect directly with proven financial talent. HireAccountants gives you instant access to thousands of pre-vetted bookkeepers, CPAs, and financial analysts who can start making an impact in as little as 24 hours.

Let's simplify your finances today!