Onboarding a new remote employee isn't just about shipping a laptop and sending a welcome email. Let’s be real. The secret sauce is creating a structured, human-centric experience that nukes the physical distance from orbit, right from the start. It’s a deliberate process of weaving them into your company's culture, workflows, and team dynamics before they even look at their first project.

Let's get real for a moment. Most advice on how to onboard remote employees is generic fluff, probably written by someone who hasn't actually felt the pain of botching it. You’re not just mailing some swag to a new sales rep who lives down the street; you’re trying to integrate a brilliant bookkeeper from Colombia into your US-based team. The stakes are completely different.

That standard "Welcome Aboard!" email followed by a link to a folder of dusty PDFs is a recipe for disaster. It fails spectacularly for specialized finance roles, where precision, trust, and deep system knowledge are non-negotiable from day one. Hope you enjoy your afternoons fact-checking their work, because that's now your full-time job.

We've all seen it happen. The first day is a chaotic mess of frantic IT tickets, awkward silences on Zoom calls, and a new hire who feels more like an island than part of the crew. A bad start isn’t just a minor hiccup; it’s a direct path to disengagement. In fact, a shocking 20% of employee turnover happens within the first 45 days.

Here are the classic friction points that can turn a promising start into a quick exit:

Bad onboarding is more than just a bad first impression. It’s a costly, self-inflicted wound that undermines the very talent you worked so hard to find. You're not just setting up an employee; you're setting the foundation for their entire tenure.

This guide is designed to cut through the noise. We're skipping the theory and diving straight into the real, tactical steps for building a process that actually works, especially if you want to find and retain a good accountant. Let's start by fixing the mistakes that everyone else is making.

A great remote onboarding experience doesn't start on the first day. It starts the moment a candidate accepts your offer. Think about it: they've just made a huge career decision. This is your first real chance to validate that choice and prove they made the right call before buyer's remorse even has a chance to set in.

Your goal is to build momentum. Get this part right, and their first day feels like stepping onto a moving walkway, not a cold, jarring start.

Forget the branded mug and stale granola bar. We're big believers in what we call the "$500 Hello." This isn't just a budget for swag; it's a strategic investment in your new hire's immediate success and well-being.

This isn't about throwing money around. It's a tangible signal that you're serious about setting them up to do their best work from the get-go.

Administrative chaos is the silent killer of a good first impression. Paperwork and setup issues dominate a staggering 52% of a new hire's first week. Even worse, nearly half of HR leaders admit they spend a full week on these manual tasks for every single new employee. When you're bringing on top-tier finance talent, that’s an entire week of value lost to the abyss.

You hired them for their brain, not their ability to fill out a W-9. Get every single piece of paperwork digitized and sent for e-signature at least one week before their start date.

The mission is simple: zero administrative tasks on Day One. Their first day should be spent meeting the team and diving into the business, not hunting for their bank's routing number.

Platforms like ours are built to handle the heavy lifting of pre-vetting candidates, which means a lot of the initial qualification work is already done, saving you critical time right from the start. (Toot, toot!)

A few days before they officially start, send a detailed welcome email that lays out a clear plan for their first week. Whose calendar should they be looking at? What meetings have already been booked for them? This removes the guesswork and anxiety.

More importantly, provide their logins to essential systems—like Slack, your project management tool, and of course, their email. Letting them poke around ahead of time helps them feel like part of the team before the clock even starts.

This proactive setup is especially critical when you hire a remote bookkeeper, as they'll need immediate and secure access to sensitive financial systems. It’s the difference between a first day filled with chaos and one that builds confidence from the first click.

The first month is everything. Vague goals like "get acquainted" are a waste of everyone's time. New hires, especially in detail-oriented finance roles, need a concrete plan. They need to build competence and confidence, not get lost in a sea of virtual ambiguity.

You've got to give them a tactical, week-by-week breakdown. This ensures your new accountant is actively rowing in the right direction from day one. Anything less is just setting them up to fail.

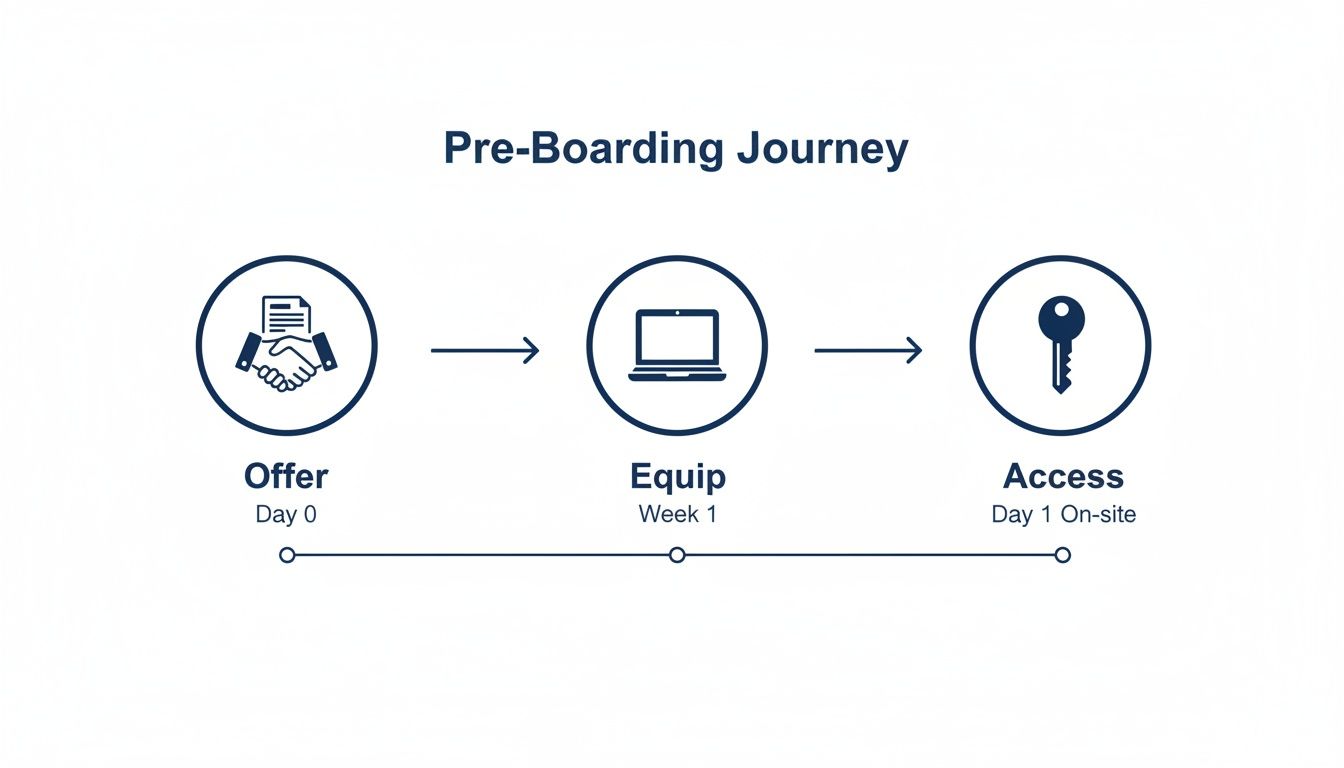

The groundwork for a successful first month actually starts before their first day. This pre-boarding phase is critical.

This visual timeline drives home a key point: the journey from offer acceptance to getting their laptop and system access has to be completely seamless. A smooth pre-boarding process prevents that dreaded first-day chaos.

The goal for week one isn't about productivity; it’s structured immersion. I'm talking about drowning them in introductions. Seriously. Pack their calendar with 25-minute meet-and-greets. They should be talking to everyone from their direct team to key contacts in sales, operations, and marketing.

Their only job this week is to learn who does what and how the company really communicates. Do the important conversations happen in a specific Slack channel? Do major decisions get made in the "meeting after the meeting"? You have to give them the unwritten rules.

The biggest mistake you can make is giving a new remote hire too much unstructured "free time." An empty calendar isn't a gift; it's a one-way ticket to feeling isolated and completely useless.

This early social mapping is non-negotiable. It’s how they learn to navigate the company's culture and build the relationships they’ll absolutely need to be effective down the road.

Okay, now it's time to shift from learning to doing. The key here is to assign small, tangible projects with crystal-clear success metrics. This is not the moment to throw them into your most complex financial modeling disaster.

For a new bookkeeper, this could be as simple as closing the books for one of your more straightforward clients. For a financial analyst, maybe it's pulling and formatting the data for just one section of the monthly FP&A report. The win itself is less important than the process of getting there.

Here's how to set them up for success:

To make this more concrete, here’s what a 30-day plan could look like for a new remote accountant. This isn't just a task list; it's a roadmap that ties actions to a clear focus and a measurable outcome each week.

| Week | Primary Focus | Key Actions | Success Metric |

|---|---|---|---|

| Week 1 | Immersion & Relationships | Attend 10+ meet-and-greets. Review core process docs for chart of accounts & expense reporting. Shadow the senior accountant during a reconciliation. | Can name key contacts in finance and at least two other departments. Can explain the expense reimbursement process. |

| Week 2 | First Contribution | Reconcile two low-complexity bank accounts. Categorize all transactions for a small subsidiary or client. | Both reconciliations completed with zero errors, reviewed and signed off by their manager or onboarding buddy. |

| Week 3 | Process Mastery | Process a full accounts payable cycle for a select group of vendors. Assist in preparing one section of a management report. | All invoices entered correctly into the system and paid on time, with no follow-up needed. Report section is accurate. |

| Week 4 | Feedback & Planning | Complete a self-assessment of their first 30 days. Participate in the 30-day check-in with their manager. Co-develop goals for the next 60 days. | Articulates 2-3 specific areas of confidence and 1-2 areas where they still need support. Goals for Day 31-90 are documented. |

A plan like this removes the guesswork. It gives both you and your new hire a shared understanding of what success looks like right from the start.

The final week of the first month is dedicated to feedback and really cementing their place on the team. You need to schedule a formal 30-day check-in that goes way beyond "How's it going?" Ask specific, targeted questions about their experience, the tools, and the training.

This isn’t just a feel-good exercise. The data shows that remote onboarding often falls short of in-person methods. In fact, only 63% of remote employees report feeling truly satisfied with their onboarding. That gap is a huge challenge, especially if you've just hired a new bookkeeping specialist from Mexico who might be feeling disoriented and confused by new systems and cultural norms. You can discover more insights about these onboarding gaps and see why getting this check-in right is so critical.

Use this meeting to review their early wins, clear up any lingering questions, and set clear expectations for the next 60 days. This conversation is how you officially transition them from being the "new hire" to a confident, fully integrated member of your team.

Let's be honest. Onboarding a remote marketer and onboarding a remote CPA are two entirely different ballgames. A mistake from one might be a typo in a blog post; a mistake from the other could be an audit notice from the IRS.

The stakes are just plain higher. The software is more specialized, and the level of trust you need to place in them is massive. You can’t just hand over a login to your accounting system and cross your fingers. This part of your onboarding needs its own dedicated playbook, one built for the precision and pressure of a finance role.

This isn't just about adding them to a Slack channel. It's about plugging them into the financial heartbeat of your company.

Your standard, one-size-fits-all software tour is a waste of time here. A new financial analyst doesn’t care where the marketing team keeps its campaign budget tracker. They need a masterclass in your financial stack, from the people who live and breathe it every single day.

I'm talking about a deep dive into your chart of accounts. Why is it structured this way? What are the historical quirks they need to be aware of? This isn’t just a list of accounts; it's the financial DNA of your business.

Your training needs to be a series of focused, hands-on workshops.

You’re not just teaching them to use tools; you’re teaching them your company’s financial philosophy. Skip this, and you’re practically inviting inconsistencies and errors down the line.

Finance teams have a totally different communication rhythm. They need deep, uninterrupted focus—constant pings and notifications are the enemy of accuracy. You have to make this crystal clear from day one.

As you figure out how to onboard remote employees, establishing a communication hierarchy for your finance team is crucial. It might look something like this:

This isn’t about creating rigid, bureaucratic rules. It’s about setting expectations so your new hire understands that you respect their need for deep work. The specifics of integrating a remote CPA are vital, which is something to consider as you learn more about hiring a CPA effectively.

Get this wrong, and you'll have a highly paid professional spending their day managing notifications instead of closing your books.

Hope is not a strategy. You’ve shipped the fancy ergonomic chair, scheduled a dozen meet-and-greets, and walked them through your entire financial stack. Now what? How do you actually know if your remote employee onboarding is working?

Hint: it’s not whether they filled out all their HR forms on time. You need a real scorecard for what matters—competence, confidence, and integration. Without clear metrics, you're just guessing, and guessing is a terrible way to build a high-performing finance team.

Let's ditch the vague "how's it going?" check-ins. You need concrete Key Performance Indicators (KPIs) that tell you if your new hire is truly on track. This isn't about micromanaging; it's about spotting friction points early, before they become serious problems.

Here’s what a performance scorecard might look like for a new remote tax accountant:

See the difference? These are not "get comfortable" goals. They are specific, measurable outcomes that prove the new hire isn't just treading water—they're starting to swim.

Numbers tell part of the story, but the human element is just as critical. A new hire could be hitting all their performance targets but feel completely isolated and ready to jump ship. This is where you need to measure the qualitative side of their integration.

You can’t see them grabbing coffee with a coworker, so you have to create a system to gauge their sense of belonging. Don't assume silence means everything is fine; it rarely does.

After their first month, send them a simple, anonymous survey. And please, don't make it a 50-question monstrosity. Five targeted questions are all you need.

The answers to these questions are pure gold. They give you a roadmap for iterating and improving your process. This is how you stop just onboarding people and start building a scalable machine that turns every new hire into a long-term asset. We’re not saying we’re perfect. Just more accurate more often.

You’ve hit the 90-day mark. The initial flurry of training sessions and introductions is over, and your new finance hire should be settling in. This isn't just an arbitrary date on the calendar; it's a make-or-break moment where a new employee either solidifies their place on the team or starts to drift.

Let's be blunt: a strong 90-day transition is what turns a promising new hire into a loyal, high-performing team member. If you get this wrong, you might find yourself right back at square one, recruiting for the same role all over again.

If your 90-day conversation is the first time your new hire is hearing about performance issues, you've already failed them. This meeting isn't about surprises. It's about cementing their role and mapping out their future with the company.

Think of it as your chance to look them in the eye (over video, of course) and confirm, "We're glad you're here, we see the value you're bringing, and we're excited about what's next." This is how you show them you're invested in their career path, not just trying to fill a vacancy.

Your goal for the 90-day meeting is to shift the conversation from 'Are you keeping up?' to 'Where do you want to go from here?' It’s a subtle but powerful change that moves from simple oversight to genuine investment in their growth.

This has to be a two-way street. Ask them directly what’s working and what isn’t. Where are they hitting roadblocks? What resources or support do they need to really hit their stride? Their honest feedback is gold—it’s a direct look into any friction points in your processes or culture.

By this point, the initial onboarding buddy has done their job. They’ve been the safe person to ask about acronyms, company quirks, and who to talk to for what. Now it’s time to help your new hire build deeper, more strategic professional relationships.

This is the perfect opportunity to introduce them to more formal mentorship.

This isn’t about babysitting. It's about being deliberate in weaving them into the broader company fabric. These cross-functional connections are vital for remote teams, where they rarely happen by chance.

The 90-day checkpoint is your last best shot to demonstrate that you’re building a cohesive team, not just managing a collection of individuals. Nail this, and you’re not just closing out an onboarding plan—you’re cementing a partnership that will pay dividends for years to come.

Ready to skip the onboarding headaches and hire top-tier remote finance talent that’s ready to contribute from day one? At HireAccountants, we connect you with pre-vetted, English-fluent accountants and finance professionals from Latin America in as little as 24 hours. Find your next finance expert and save up to 90% on payroll today.

Let's simplify your finances today!