An interim CFO service parachutes a seasoned financial leader into your business on a temporary basis. Think of it as calling in a strategic financial co-pilot when you're flying through a storm—maybe you're navigating a messy fundraising round, a surprise acquisition offer, or just the beautiful chaos of unchecked growth. You get the executive brainpower without the six-figure salary and long-term commitment.

Let's cut the crap. You're a founder, not a financial wizard. You're brilliant at building products and charming investors, but staring at a cash flow statement gives you a low-grade headache. You know you need senior-level financial guidance, but the idea of adding another massive salary to the payroll is enough to make you physically ill.

This is precisely where interim CFO services shift from a trendy buzzword to an absolute lifeline.

This isn't about hiring a glorified bookkeeper to chase down overdue invoices. An interim CFO is a temporary, high-impact executive who steps in to solve a specific, high-stakes problem. They're the specialist you bring in for critical surgery, not the general practitioner you hope can figure it out.

And this isn't just a big-business luxury anymore. The demand for interim and fractional CFOs has skyrocketed by an incredible 310% since 2020. In fact, CFOs now account for over 51% of all interim C-suite placements. That’s not a blip; it’s a fundamental change in how smart companies navigate growth. You can explore more about this surge in demand for flexible finance leadership to understand why your competitors are probably already on this.

One of the most expensive mistakes I see founders make is hiring the wrong person for the job. They hire a controller and then get mad when they can't get strategic fundraising advice. Or they hire a bookkeeper and wonder why their financial model is a dumpster fire.

It’s like asking a plumber to rewire your house. Different jobs, different skills. Let’s clear this up so you don’t make the same mistake.

| Role | Primary Focus | Typical Question They Answer |

|---|---|---|

| Bookkeeper | The Past | "What did we spend on software last month?" |

| Controller | The Present | "Is our monthly financial reporting accurate?" |

| Interim CFO | The Future | "How do we structure our finances to raise our next round without giving away the farm?" |

See? A bookkeeper documents what happened, a controller makes sure the documentation is right, and an interim CFO uses that information to chart a course for the future.

The role of a CFO has evolved from number cruncher to strategic partner. They’re no longer just gatekeepers; they’re co-pilots helping you fly the plane.

An interim CFO isn't there to count the beans; they're there to help you grow more of them. Understanding this difference is the first step toward getting the right help and not wasting a pile of cash.

Let’s be honest, your gut is probably already telling you something’s off. That low-grade anxiety that spikes every time someone mentions "burn rate" isn’t just you needing more coffee. It’s a symptom. And in a startup, symptoms you ignore have a nasty habit of turning into fatal diseases.

Too many founders wait until the house is on fire to call the fire department. They think they can handle the finances with a spreadsheet and a prayer, right up until the moment they realize the spreadsheet is wrong and the prayer isn't working.

These aren’t some vague, theoretical business school problems. These are the real-world, 'oh crap' moments that should have you looking for interim CFO services yesterday.

This one is a classic, and it's terrifying. You stood in front of your investors, oozing confidence, and told them you had a solid 12 months of runway. Your projections looked great—on paper. But now, just a few months later, a quick look at the bank account tells a very different story. Turns out you actually have five months, maybe six if you stop buying fancy coffee for the office.

This isn't just bad math; it's a credibility killer. An interim CFO parachutes in to build a financial model that doesn't just look pretty but actually reflects reality. They pressure-test your assumptions and give you the real numbers, even when they’re ugly.

A bigger company comes knocking with an acquisition offer. Everyone is celebrating. Then comes due diligence. They ask for your financials, your cap table, your historical data room… and you hand over a chaotic mess of disconnected spreadsheets and QuickBooks reports.

The deal evaporates. Why? Because messy books scream risk. If you can’t even track your own money properly, how can they trust your revenue claims? An interim CFO is your pre-deal cleanup crew, organizing your financials into a professional, audit-ready package that inspires confidence, not concern.

Messy financials are the number one killer of otherwise promising M&A deals and fundraising rounds. Investors and acquirers don't invest in chaos; they invest in clarity.

They make sure your story is backed up by unimpeachable numbers, which is the only language that matters in these high-stakes conversations.

Are your board meetings starting to feel less like strategy sessions and more like hostile interrogations? Are you getting peppered with questions you can’t answer?

If you're fumbling for answers, you've got a serious problem. Your board isn't trying to torture you; they're trying to do their job, and you're not giving them the data they need. An interim CFO doesn't just prepare the reports; they translate them. They build the KPI dashboards and narrative that turn these beatdowns into productive discussions about the future.

So, you’ve pulled the trigger and hired an interim CFO. Smart move. But what happens next? Does a seasoned pro just show up, wave a magic Excel wand, and suddenly your burn rate makes sense and investors are lining up?

Not quite. Let’s get real about what you should expect—and what you should demand. Forget vague promises of "strategic oversight." We're talking about the concrete work product that separates a true financial co-pilot from a glorified accountant who costs more.

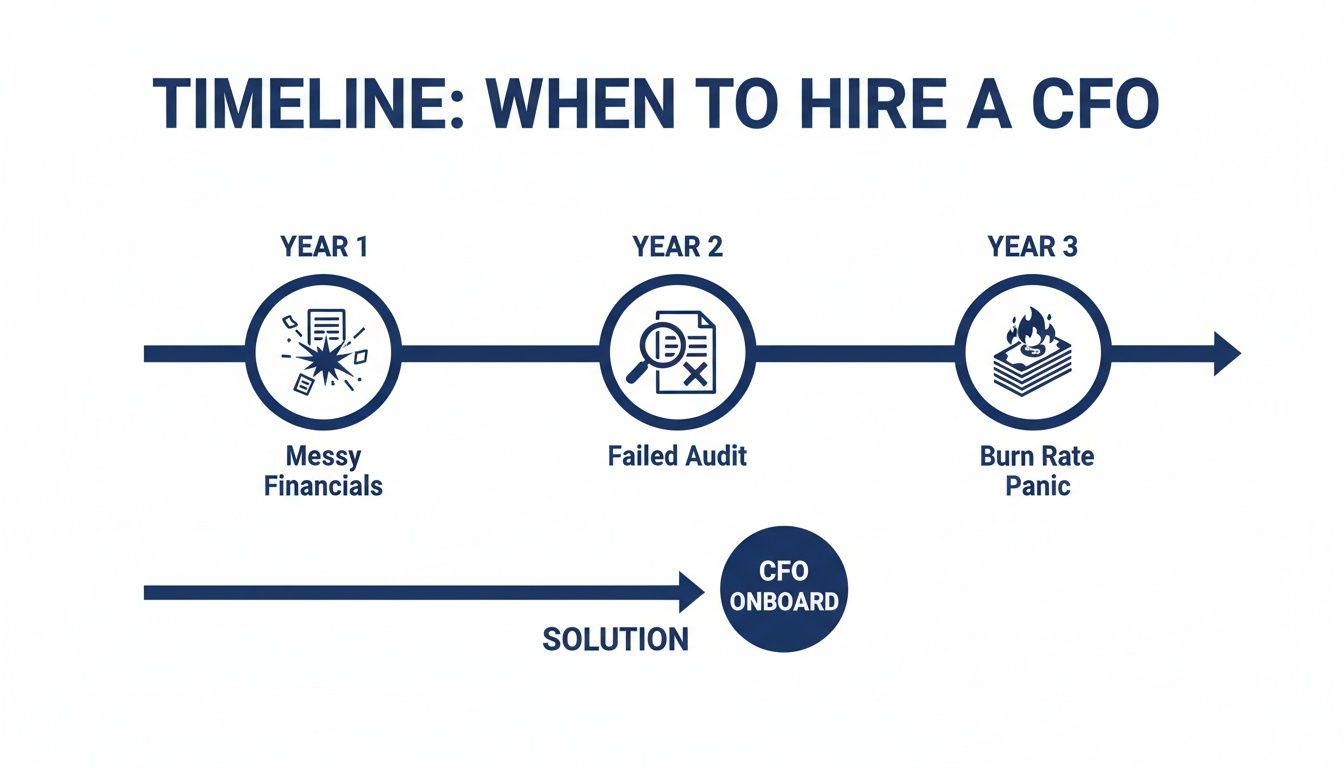

Many founders wait too long, and small issues snowball into company-threatening crises. This timeline shows just how quickly that can happen.

As you can see, financial problems only get worse with time. A small reporting error in year one becomes a due diligence nightmare in year three.

First, the tangible stuff. These aren't nice-to-haves; they're the foundational assets a competent interim CFO should build or fix within the first 90 days. If your candidate isn't talking about these, they’re the wrong person.

Beyond the spreadsheets, a top-tier interim CFO delivers value that is less tangible but equally important. This is what separates the strategists from the number crunchers. And if you find you need this guidance long-term, it's worth exploring the differences between interim and fractional CFO services.

An interim CFO isn't there to just count the beans; they're there to help you grow more of them. Their role is to translate numbers into a narrative that investors, your board, and your team can actually understand.

This is where the real magic happens.

To make sure your interim CFO hits the ground running, their first three months should be all about triage and immediate value. Here’s what that looks like:

Ultimately, a good interim CFO brings clarity to chaos. Insist on these deliverables, and you’ll get your money’s worth.

Alright, let's talk about the elephant in the room: the price tag. Hiring an interim CFO isn't cheap, but it’s a hell of a lot cheaper than accidentally driving your company off a financial cliff because you were trying to "save money."

Let's get one thing straight. The cost isn't the point—the value is. Comparing the cost of a full-time, big-city CFO (think $400k+ a year plus equity) to a surgical, high-impact interim expert is like comparing a sledgehammer to a scalpel. You don't need the sledgehammer for a three-month operation.

You’ll generally run into three pricing models. None are inherently "better," but one will be a better fit for your specific mess. I mean, situation.

| Model | Typical Cost Range | Best For… | Watch Out For… |

|---|---|---|---|

| Hourly Rate | $250 – $750+ per hour | Urgent, specific, and short-term tasks like M&A due diligence or crisis management. | Scope creep. Without tight project management, hours can balloon unexpectedly. |

| Project-Based Fee | $20k – $100k+ per project | Defined initiatives with clear start/end dates, such as a capital raise or a system implementation. | Mid-project scope changes. Any new requests will likely require a new SOW and additional fees. |

| Monthly Retainer | $10k – $30k+ per month | Engagements lasting 3-9 months, requiring ongoing strategic guidance and hands-on leadership. | Vague deliverables and endless engagements. You must define clear goals and an exit strategy. |

Choosing the right model is all about aligning the pricing structure with the problem you need to solve.

Here's the inside scoop: you don't need to pay a premium for someone in a New York or San Francisco high-rise. The market for remote financial expertise has exploded. This is a massive win for you.

The virtual CFO market, closely related to interim CFO services, is forecasted to hit $10.74 billion by 2035. A key driver is that 57% of small and medium businesses cite cost optimization as their main reason for outsourcing finance leadership. You can read more about the virtual CFO market trends to see how big this shift really is.

Tapping into a global talent pool means you can get the same caliber of expertise without mortgaging the office ping-pong table. It's about finding the right brain, not the right zip code.

By hiring pre-vetted, US-aligned talent from a global hub, you dramatically change the cost equation. And as you weigh your options, you'll find there are many benefits of outsourcing accounting services beyond just cost savings. It’s about getting smarter, faster financial leadership without the traditional overhead.

Alright, let's get real. The market for interim CFO services is packed. Some candidates are genuine strategic wizards. Others are just accountants with a fancier title and a higher day rate.

Your job is to spot the difference before you sign a contract. Think of yourself as a detective. You’re looking for someone who has actually been in the trenches, not just someone who read a book about startup finance.

Forget the fluffy questions. "What are your greatest strengths?" won't tell you if they can handle the beautiful disaster that is your company. You need questions that force them to reveal their real-world problem-solving skills.

You're not hiring for a corporate giant where they can hide behind a team of analysts. You're hiring a co-pilot who needs to navigate turbulence from day one. For more on this, our guide on how to find a good accountant covers foundational principles that apply here, too.

Here are the questions that separate the pros from the pretenders:

There's a specific type of candidate you need to watch out for: the corporate lifer who thinks a startup will be a fun "sabbatical." They're used to big teams, massive budgets, and moving at a glacial pace. Your environment will break them.

How do you spot one?

A true startup-ready CFO has scar tissue. They've lived through pivots, down rounds, and near-death experiences. They aren't looking for a perfect situation; they're energized by the challenge of creating one.

Finally, don't just check references—interrogate them. Don't ask, "Were they good to work with?" That’s a polite, useless question.

Instead, ask targeted questions:

This turns a box-ticking exercise into an intelligence-gathering mission. It’s the final piece of the puzzle.

Okay, you're sold. You know you need an interim CFO. But the idea of wading through hundreds of LinkedIn profiles and paying astronomical recruiter fees? It’s enough to make your head spin.

Hope you enjoy spending your afternoons fact-checking resumes—because that’s now your full-time job. Or… maybe not.

This is where a modern approach to hiring gives you a serious leg up. Platforms that connect you directly with pre-vetted, globally-sourced financial talent are the fastest way to get the help you actually need.

Let's be honest: traditional recruiting is a startup’s worst enemy. It’s a time-suck, a money pit, and it's loaded with friction. You can spend weeks waiting for a recruiter to send over a short list of overpriced local candidates, only to realize they don’t have real startup DNA.

All the while, your financial challenges aren't sitting on hold.

The old model forces you to choose between speed, quality, and cost. A modern talent platform is built to deliver all three.

Instead of starting from zero, what if you could tap into a curated network of professionals who have already been rigorously vetted? That’s the core idea behind platforms offering interim CFO services.

This isn't a magic wand, but it's a hell of a lot faster, smarter, and more affordable than the alternative. It’s how you get the strategic financial leadership you need now.

If you’ve read this far, you’re likely weighing your options. You've probably got some questions buzzing around. Let's get you some straight answers.

Let's reframe that. The real question is, "Can we afford not to?" If you're stressed about your burn rate, fumbling a crucial fundraising round, or facing tough questions from your board, you're already paying a steep price in lost opportunities and costly errors.

A top-tier, full-time CFO in a major US city can easily command a salary over $400,000 a year, plus equity. An interim expert brings that same high-caliber strategic mind to your team for a fraction of that, precisely when you need it most. The true cost isn't the consultant's fee; it's the damage done by the financial mistakes you make without one.

This trips people up, but the difference is simple. Think of it in medical terms.

An interim CFO is like a trauma surgeon. You bring them in for a specific, high-stakes procedure—an acquisition, a turnaround, a major system implementation. They're typically full-time for a short, intense sprint (3-9 months) and then their job is done.

A fractional CFO is your primary care doctor. They're with you part-time over the long haul, providing consistent check-ups and strategic guidance to keep the business healthy as it grows.

One is for a critical mission. The other is for ongoing financial wellness. Knowing which one you need is half the battle.

Much faster than you think. The traditional hiring route can drag on for months. By the time you find someone, the fire you were trying to put out may have already spread.

This is where modern talent platforms are a game-changer. Instead of starting from square one, you get access to a curated pool of experts who have already been vetted. For most urgent situations, you can have a qualified, ready-to-work interim CFO meeting your team in as little as 24-48 hours.

Tired of navigating complex financial challenges alone? HireAccountants connects you with pre-vetted, US-aligned interim CFOs, often in just 24 hours and at a fraction of the cost of a full-time hire. Stop guessing and start scaling with confidence by exploring your options at https://hireaccountants.com.

Let's simplify your finances today!